The US dollar index saw a weak run over the week as investors flocked to safe-haven currencies following another volatile trading session of US stocks market.

LME aluminium saw a bearish week as the removal of US sanctions on Rusal created a relaxed atmosphere in the market. The week saw three trading days as the LME was closed on Tuesday for Christmas and on Wednesday for Boxing Day. LME aluminium started the week’s trading on 24th December at US$ 1898.50 per tonne, lowest in last two years. After the two holidays, it opened lower again and then extended its losses on Thursday night hovering at US$ 1898 per tonne. Finally, the aluminium contract closed the week at US$1881 per tonne. It is expected to trade at US$1,850-1,900 per tonne in the coming week.

{alcircleadd}

As on December 28, LME aluminium cash (bid) price stood at US$ 1880 per tonne, LME official settlement price stands at US$ 1881 per tonne; 3-months bid price stands at US$ 1856.50 per tonne, 3-months offer price is US$ 1857 per tonne; Dec 19 bid price stands at US$ 1930 per tonne, and Dec 19 offer price stands at US$ 1935 per tonne.

The LME aluminium opening stock increased slightly to 1267125 tonnes. Live Warrants totalled at 1026950 tonnes, and Cancelled Warrants were 240175 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1873 per tonne.

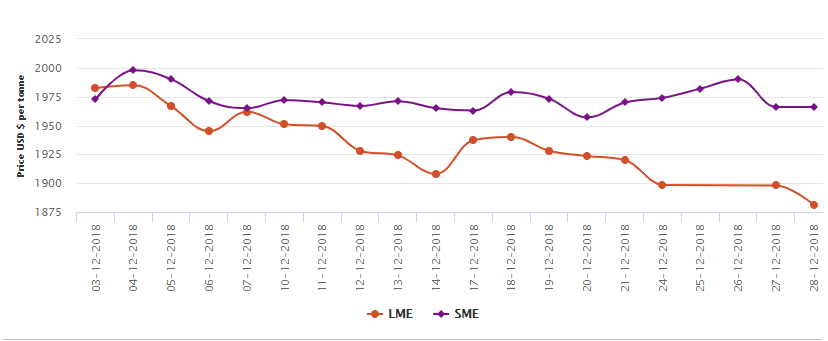

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange started the week lower and after a mid-week high to US$ 1990 per tonne, it fell again to US$ 1966 per tonne on Friday.

A significant decline in alumina prices mid-week lowered the SHFE 1902 contract to a low of RMB 13,645 per tonne, as longs left. A loss of 14,456 lots of open interest ended the contract at RMB 13,650 per tonne. The SHFE 1902 contract fell to close at RMB 13,565 per tonne overnight on Friday. Recent declines in alumina prices and a rebound in social stocks affirmed our expectations that aluminium prices in China would fall into the medium term. Falling LME counterpart will also have a negative impact on the prices. The contract is expected to trade at RMB 13,520-13,650 per tonne in the coming week with spot discounts at RMB 120-80 per tonne.

Responses