The US dollar changed little against a basket of currencies, sticking close to a two-week low. Base metals closed mixed and LME aluminium jumped 1.5%. SHFE aluminium increased 0.51%.

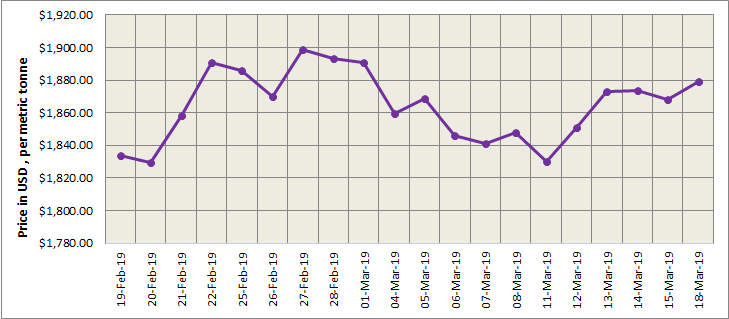

A lower US dollar lifted LME aluminium from last Friday’s closing to US$1879 per tonne during the first day of the week. As shorts exited, LME aluminium rebounded from a low of US$1,880.5 per tonne and jumped to the highest since February 18, at US$1,928.5 per tonne during night trading. It may trade at US$1,860-1,940 per tonne today.

{alcircleadd}

As on March 18, LME aluminium cash (bid) price stood at US$ 1878 per tonne, LME official settlement price stands at US$ 1879 per tonne; 3-months bid price stands at US$ 1898 per tonne, 3-months offer price is US$ 1899 per tonne; Dec 20 bid price stands at US$ 2025 per tonne, and Dec 19 offer price stands at US$ 2030 per tonne.

The LME aluminium opening stock decreased to1175650 tonnes. Live Warrants totalled at 650675 tonnes, and Cancelled Warrants were 524975 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1901 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange increased from US$ 2024 per tonne on March 18 to at US$ 2036 per tonne today.

The most liquid SHFE aluminium May contract traded rangebound during the day and maintained Friday night’s losses yesterday. It lost 0.33% to close the trading day at RMB13,600 per tonne. The SHFE 1905 contract then rose to the highest overnight at RMB13,680 per tonne and closed at RMB13,665 per tonne. Domestic consumption remained tepid, and this may see the contract at RMB13,500-13,800 per tonne today. Spot premiums are set at RMB 180-220 per tonne.

Social inventories of primary aluminium as of Monday March 18 rose some 5,000 tonnes from a week ago, suggesting the slow pace of downstream recovery. This and further downside room in input costs would likely keep aluminium prices rangebound in the short time.

Responses