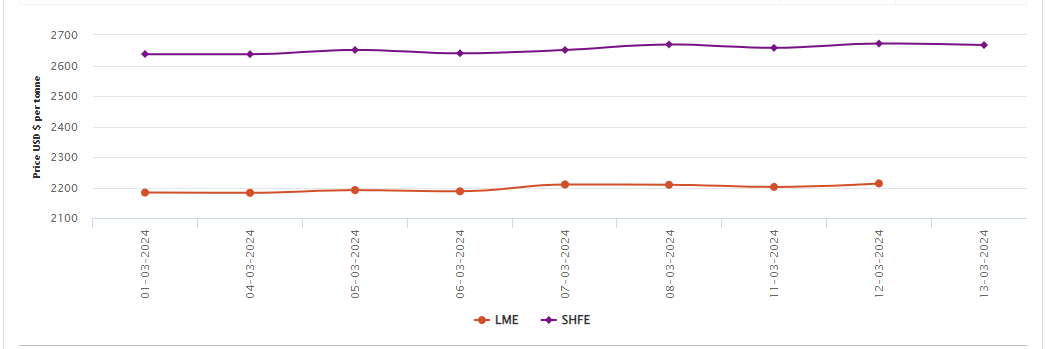

LME aluminum opened at US$$2,250 per tonne on Tuesday, March 12, with high and low at US$2,270 per tonne and US$2,242.50 per tonne, respectively, before closing at US$2,263 per tonne, up US$11 per tonne or 0.49 per cent.

On Tuesday, March 12, LME aluminium cash bid price and LME aluminium official settlement price built up by US$11.50 per tonne or 0.52 per cent to stand at US$2,213 per tonne and US$2,213.50 per tonne, marking about a six-week high.

Aluminium demand in the global market has recovered in the ongoing traditional peak season, but supplies from top producers in China are yet to fill the gap. In addition, a firmer US currency after inflation data above consensus also added pressure to industrial metals.

3-month bid price and 3-month offer price moved up by US$20 per tonne to reach US$2,262 per tonne and US$2,263 per tonne, respectively. December 25 bid price and December 25 offer price also added US$20 per tonne on March 12, amounting to US$2,468 per tonne and US$2,473 per tonne.

The demand-supply gap led to a fall in LME aluminium opening stock by 2,000 tonnes to 575,675 tonnes. Live Warrants and Cancelled Warrants stood at 348,975 tonnes and 226,700 tonnes. While the former remained restrained, the latter decreased by 2,000 tonnes to peg at 226,700 tonnes.

LME aluminium 3-month Asian Reference Price grew by US$9.8 per tonne to clock at US$2,252.75 per tonne.

SHFE aluminium price

On Wednesday, March 13, the SHFE aluminium benchmark price dipped by US$5 per tonne to settle at US$2,667 per tonne, following an increase of US$14 per tonne on the previous day.

The most-traded SHFE 2404 aluminum contract opened at RMB 19,205 per tonne overnight, with its low and high at RMB 19,130 per tonne and RMB 19,220 per tonne before closing at RMB 19,210 per tonne, up RMB 30 per tonne or 0.16 per cent.

Responses