The US dollar eased against a basket its rivals on Friday, as investors digested the news of the US imposing fresh sanctions on Iran and weaker-than-expected US jobs data.

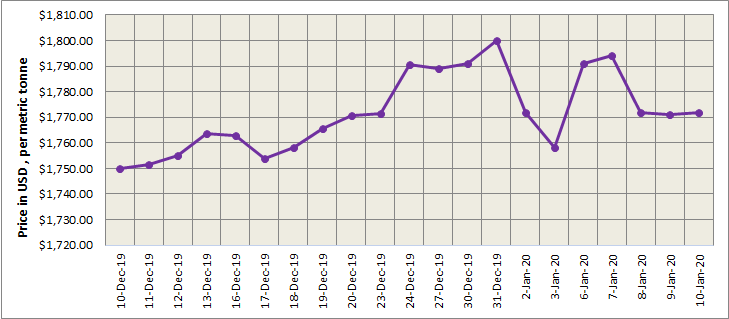

As on Friday January 10, LME aluminium cash (bid) price continued to drop to stand at US$1770 per tonne, while LME official settlement price to US$1770.50 per tonne after inching down from US$1771 per tonne on January 9. 3-months bid price also decreased to US$ 1797.50 per tonne and 3-months offer price US$ 1798 per tonne. Dec 20 bid price clocked at US$ 1935 per tonne and Dec 20 offer price at US$ 1940 per tonne.

{alcircleadd}

The LME aluminium opening stock further declined to 1410675 tonnes, compared with 1425575 tonnes on January 9. Live Warrants totalled at 797175 tonnes and Cancelled Warrants 613500 tonnes.

LME aluminium 3-months Asian Reference Price came in at US$ 1808.75 per tonne.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE (Shanghai Future Exchange) continued to extend growth on Monday, January 13, to come in at US$2099 per tonne.

The most traded SHFE 2003 contract inched down to RMB 14,065 per tonne on Friday night. It is likely to move at RMB 14,000-14,150 per tonne today, while spot discounts are seen at a maximum of RMB 40 per tonne against the SHFE 2001 contract.

Responses