The US dollar recovered lost ground on Wednesday, March 4, after a day of an emergency interest rate cut by the Federal Reserve knocked the greenback to an eight-week low. The dollar index, which tracks the greenback against a basket of other currencies, bounced back 0.43% and hit an intraday high of 97.6.

Three-month LME aluminium slipped to as low as US$ 1,717 per tonne overnight before easing some losses and ending down 0.26 per cent on the day. Limited improvement in fundamentals kept aluminium prices under pressure. LME aluminium is expected to be traded between US$1,705 per tonne and US$ 1,750 per tonne.

{alcircleadd}

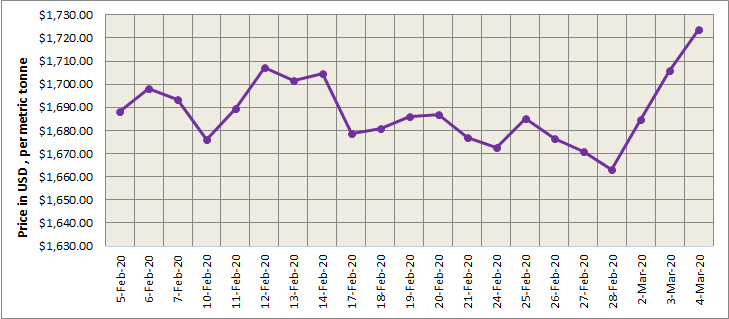

LME aluminium cash (bid) price, as of Wednesday, March 4, continued to extend its growth significantly by US$ 17 per tonne to stand at US$ 1722.5 per tonne, while LME official settlement price increased by US$ 17.5 per tonne to come in at US$ 1723.5 per tonne. 3-months bid price stood at US$ 1731 per tonne, while 3-months offer price at US$ 1732 per tonne. Dec 21 bid price hovered at US$ 1848 per tonne and Dec 21 offer price at US$ 1853 per tonne.

The LME aluminium opening stock declined from 1071875 tonnes to 1050750 tonnes. Live Warrants totalled at 791550 tonnes and Cancelled Warrants 259200 tonnes.

LME aluminium 3-months Asian Reference Price stood at US$ 1722.50 per tonne.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE increased marginally today, on March 5, to stand at US$1,889 per tonne from US$1,888 per tonne on March 4.

The buildup of short positions sent the SHFE 2004 contract below the five-day moving average to a low of RMB 13,155 per tonne in morning trade, within striking distance of a three-year low plumbed last Friday. The contract later recovered some ground to end at RMB 13,205 per tonne, still below the five-day moving average. SMM calculations showed that average costs for primary aluminium production have climbed to RMB 13,400 per tonne. Strong support is expected at RMB 13,200 per tonne for SHFE aluminium, as its LME counterpart has strengthened on a weaker US dollar after the Fed’s interest rate cuts.

The most-traded SHFE contract is expected to be at RMB 13,050 per tonne to RMB 13,300 per tonne today.

Responses