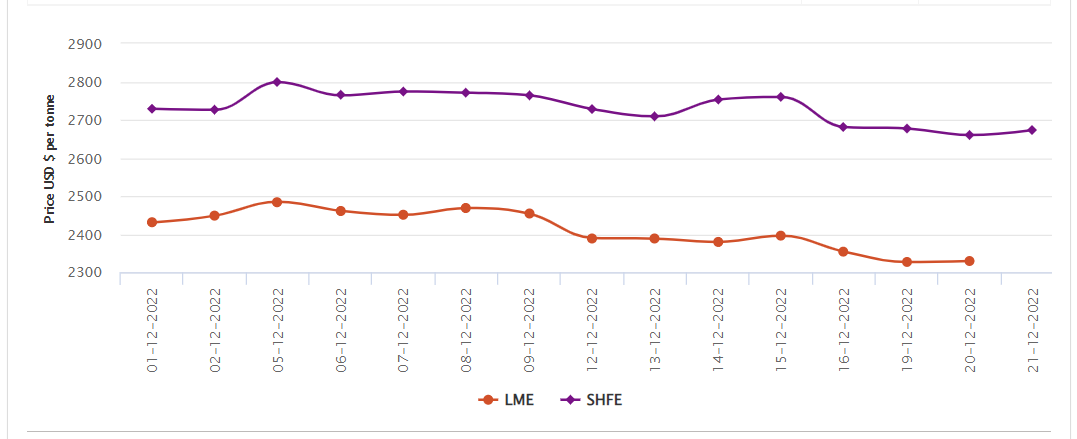

LME aluminium opened at US$2,370 per tonne on Tuesday, December 20, with high and low at US$2,410 per tonne and US$2,363.50 per tonne, respectively, before closing at US$2,371.50 per tonne, a gain of US$1.5 per tonne or 0.06 per cent.

On Tuesday, December 20, LME aluminium cash bid price slightly grew by US$4 per tonne to settle at US$2,329 per tonne, and LME aluminium official settlement price inched up by US$2.50 per tonne to rest at US$2,329.50 per tonne.

3-month bid price and 3-month offer price increased by US$6.50 per tonne and US$7 per tonne, respectively, to peg at US$2,370 per tonne and US$2,371 per tonne. December 23 bid price and December 23 offer price rose by US$5 per tonne to hover around US$2,453 per tonne and US$2,458 per tonne.

LME aluminium opening stock further suffered a loss of 1,025 tonnes to close at 478,500 tonnes. Live warrants and Cancelled warrants clocked at 237650 tonnes and 240850 tonnes, respectively.

LME aluminium 3-month Asian Reference Price remained mostly muted at US$2,383.75 per tonne, compared to US$2,383.05 per tonne on the previous day.

SHFE aluminium price

On Wednesday, December 21, the SHFE aluminium benchmark price has gained US$13 per tonne to stand at US$2,673 per tonne, following a decline of US$17 per tonne from US$2,677 per tonne to US$2,660 per tonne.

The most-traded SHFE 2301 aluminium contract opened at RMB 18,600 per tonne overnight, with its high and low at RMB 18,645 per tonne and RMB 18,560 per tonne before closing up RMB 20 per tonne or 0.11 per cent.

The most-traded SHFE 2301 aluminium closed down 0.38 per cent or RMB 70 per tonne at RMB 18,590 per tonne, with open interest down 4,299 lots to 129,323 lots.

Responses