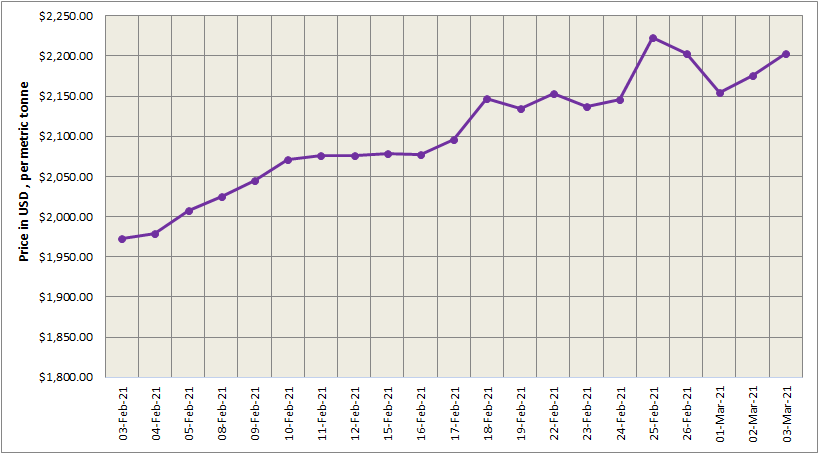

Three-month LME aluminium fell 0.43 per cent to close at US$ 2215 per tonne on Wednesday, with open interest rising to 704,000 lots. It is expected to trade between US$ 2100-2300 per tonne today.

LME aluminium cash (bid) price and LME official settlement price expanded by US$ 27 per tonne on Wednesday, March 3, to stand at US$ 2203 per tonne. 3-months bid price and 3-months offer price came in at US$ 2207 per tonne, up by US$ 28.50 per tonne from US$ 2178.50 per tonne. Dec 22 bid price and Dec 22 offer price stood at US$ 2247.50 per tonne compared to US$ 2229.50 per tonne on March 2.

The LME aluminium opening stock decreased from 1307125 tonnes on Tuesday to 1304075 tonnes on Wednesday, March 3. Live Warrants totalled 1084825 tonnes, while Cancelled Warrants stood at 219250 tonnes.

LME aluminium 3-months Asian Reference Price surged from US$ 2122.71per tonne on March 2 to US$ 2230.22 on March 3.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE continued to increase, although slower from the previous day, to stand at US$ 2724 per tonne on Thursday, March 4, in comparison with US$ US$ 2713 per tonne on Wednesday.

The most-liquid SHFE 2104 aluminium contract rose 0.86 per cent to settle at RMB 17,565 per tonne on Wednesday night, and is likely to trade between RMB 17,200-17,600 per tonne on Thursday.

Responses