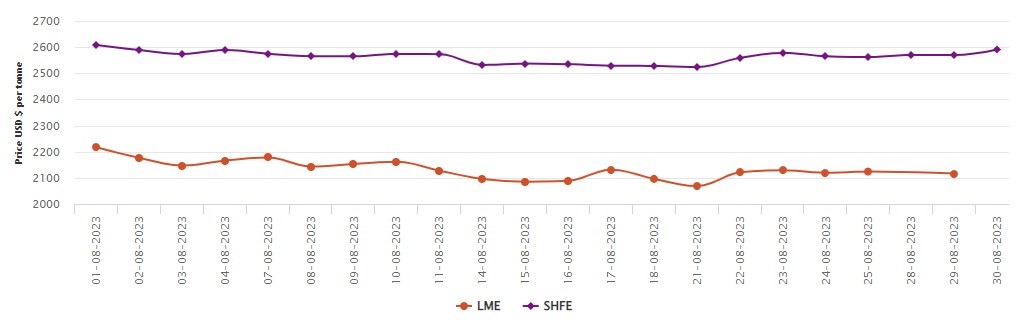

LME aluminium opened at US$2,152 per tonne on Tuesday, with its high and low at US$2,179.5 per tonne and US$2,152 per tonne, respectively, before closing at US$2,169 per tonne, an increase of US$18.5 per tonne or 0.86 per cent from the previous trading day.

On Tuesday, August 29, both LME aluminium cash bid price and LME aluminium official settlement price slipped by US$7 per tonne or 0.39 per cent and US$7.5 per tonne or 0.35 per cent to close at US$2,116 per tonne and US$2,116.50 per tonne.

As per the London Metal Exchange (LME) data, both 3-month bid price and 3-month offer price inched down by US$1 per tonne or 0.04 per cent and US$0.5 per tonne or 0.02 per cent to close at US$2,159 per tonne and US$2,160 per tonne.

December 24 bid price and December 24 offer price dropped by US$7 per tonne or 0.30 per cent to come in at US$2,313 per tonne and US$2,318 per tonne. LME aluminium opening stock halted at 524025 tonnes. Live warrants and Cancelled warrants closed at 230575 tonnes and 293450 tonnes.

LME aluminium 3-month Asian Reference Price inched up by US$1.3 per tonne to clock at US$2,165.54 per tonne.

SHFE aluminium price

On Monday, August 30, the Shanghai Futures Exchange (SHFE) aluminium benchmark price expanded by US$21 per tonne or 0.81 per cent to settle at US$2,591 per tonne. Overnight, the most-traded SHFE 2309 aluminium contract opened at RMB 18,660 per tonne, with the lowest and highest prices at RMB 18,650 per tonne and RMB 18,725 per tonne before closing at RMB 18,700 per tonne, up RMB 50 per tonne or 0.27 per cent from the previous trading day.

Responses