The US dollar slipped on Wednesday, July 1, in choppy trading, with the market having a modest appetite for risk-taking amid generally upbeat US data and improving European economic numbers.

The dollar index, which tracks the greenback against basket of its peers, touched a one-week low of 97.025 before closing at 97.153.

{alcircleadd}Three-month LME aluminium hovered in a broad range between US$ 1,615-1,626 per tonne before closing the day higher at US$1,618 per tonne, continuing the price rally.

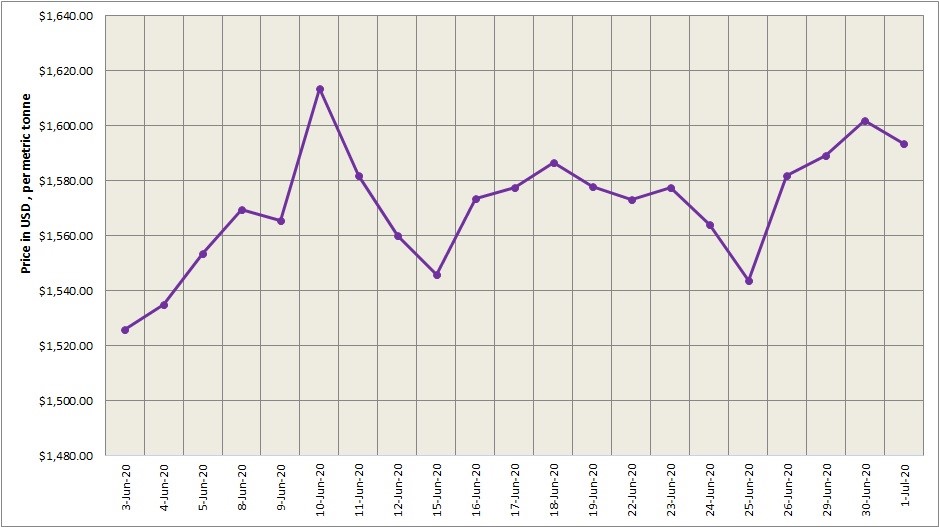

As of Wednesday, July 1, LME aluminium cash (bid) price and LME official settlement price, however, decreased from US$ 1602 per tonne to US$ 1593.50 per tonne. 3-months bid price and 3-months offer price stood at US$ 1614 per tonne after declining by US$ 7.5 per tonne from the previous day. Dec 21 bid price and Dec 21 offer price came in at US$ 1713 per tonne compared to US$ 1722 per tonne on Tuesday, June 30.

The LME aluminium opening stock totalled 1638300 tonnes, down by 4300 tonnes from 1642600 tonnes on June 30. Live Warrants stood at 1472775 tonnes, while Cancelled Warrants 165525 tonnes.

LME aluminium 3-months Asian Reference Price hovered at US$ 1621.62 per tonne.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE increased for the third consecutive day to stand at US$ 2018 per tonne on Thursday, July 2.

The most-liquid SHFE August contract notched the highest since January 23 at RMB 14,050 per tonne before closing up 1.67 per cent at RMB 14,030 per tonne, as longs aggressively loaded up positions while shorts covered their positions. The contract is within striking distance of the upper Bollinger band and likely to move at RMB 13,690-14,150 per tonne tonight.

Premiums for the SHFE July contract over the August one have widened to RMB 250 per tonne, pointing to tight spot availability amid falling inventories.

The most-liquid SHFE August contract also trended upward, rising to a session high of RMB 13,850 per tonne, which is close to the peak level back in January, and ending higher on the day at RMB 13,900 per tonne. The contract is seen trading between RMB 13800-14100 per tonne today with spot premiums elevated.

Responses