After Easter holidays LME aluminium opened higher today. Shanghai Metals Market expects it to rise and test support at the five-day moving average today and trade at US$2,005-2,030 per tonne.

On Thursday, March 29, London Metal Exchange aluminium hit a near eight-month low, closing the week just above $2,000 a tonne. SMM expects LME aluminium to hover around the US$2,000 per tonne level this week and trade at US$1,995-2,020 per tonne with limited upward room given US-China trade tension and higher inventories.

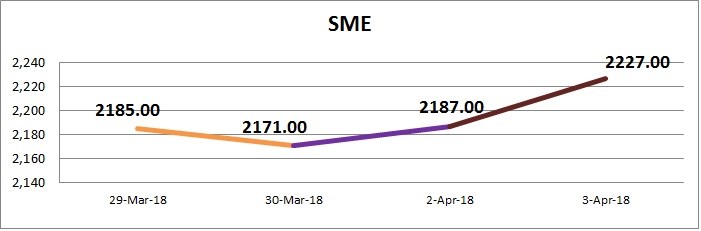

{alcircleadd}SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange increased from US$ 2187 per tonne on April 2 to US$ 2227 per tonne on April 3, while LME was closed and trading in China market started picking up.

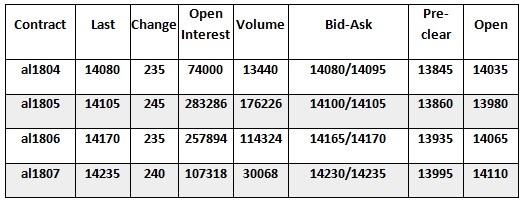

SHFE aluminium regained lost ground and inched up to a high of 13,995 yuan/mt today as investors covered their shorts. Prices are likely to rise further in the short term, supported by a falling inventory and potential rising input costs. SHFE aluminium traded rangebound at the 20-day moving average and RMB 14,000 per tonne last night. As China aluminium inventories continue to decline and prices of bauxite and alumina are settling on a higher range, SMM expects SHFE aluminium to trade range bound at RMB 13,950-14,150 per tonne today. Spot discounts will range within RMB 110-70 per tonne. Following is the SHFE aluminium price movement on April 3, as updated by shfe.com.

The eurozone’s Markit manufacturing PMIs for March are key factors to watch today. The US dollar index rebounded to 90 following the release of upbeat economic data and is expected to test support at 90 in the short term, while base metals are likely to continue to see mixed trading today.

Responses