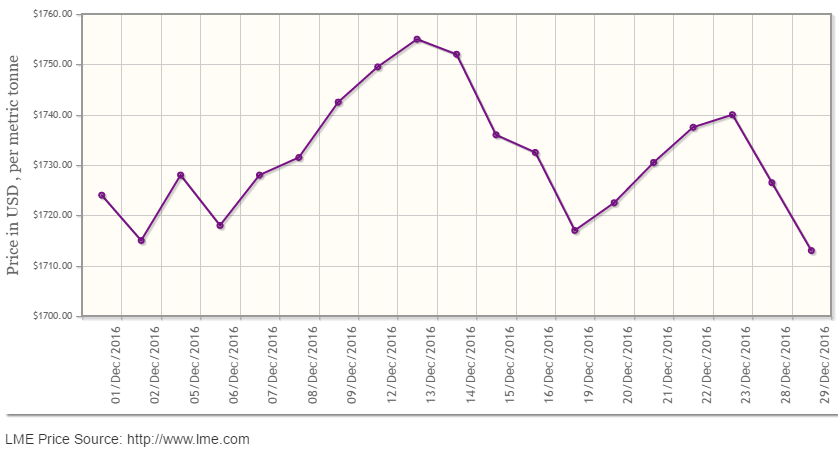

The year-end liquidity crunch is getting reflected way too acutely on the LME aluminium prices, and this is evident from the falling prices of the metal on the bourse. LME aluminium closed at US$1,713 per tonne after Thursday's night trading, down 0.78 per cent from the previous day. Today happens to be the last trading day of the year, and Shanghai Metals Market analysis predicts the contract will keep falling on Friday moving at US$1,670-1,690 per tonne range.

“Trading is estimated to be light during the last trading day of 2016, with small falling room,” SMM says.

{alcircleadd}Crude oil, one of the key macroeconomic factors, hit highest the level since July 2015 on hopes of supply cut. So, analysts are expecting global aluminium prices will improve in the new year. Light sweet crude futures for delivery in February on the Nymex rose by 1.7 per cent.

As on December 29, LME official cash buyer price of aluminium stands at US$1,712.5 per tonne, cash seller and settlement price is US$1,713 per tonne, 3M buyer price is US$1,701 per tonne, 3M seller price is US$1,701.5 per tonne, Dec1 buyer price is US$1,715 per tonne and Dec1 seller price is US$1,720 per tonne. LME official Opening Stock of aluminium currently stands at 2176800 tonnes, total Live Warrants is estimated at 1540625 tonnes, and Cancelled Warrant is 643050 tonnes.

In China, benchmark price of aluminium on Shanghai Metal Exchange stands at US$1,869 per tonne on Friday, December 30. The price has risen marginally by 1.79 per cent from the previous day.

Aluminium traded on Shanghai Futures Exchange is expected to remain weak on Friday. SHFE 1702 aluminium increased to above the 10-day moving average on Thursday’s night trading. The contract will keep ranging between RMB 12,550-12,750 per tonne on Friday, predicts SMM.

{googleAdsense}

Spot aluminium in China’s domestic market should trade at premiums of RMB 100-140 per tonne on Friday, forecasts SMM.

Responses