您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

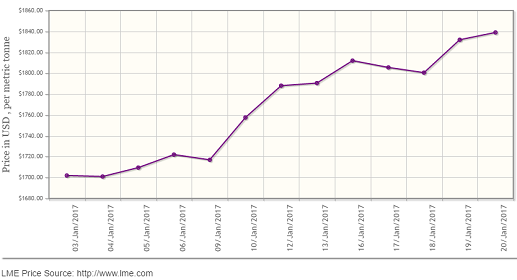

LME aluminium kept logging higher till the end of last week as dollar index was at its low. The contract closed at US$1,839 per tonne after Friday's night trading, edging higher by 0.32 per cent from the previous day. Shanghai Metals Market forecast says LME aluminium will keep firm and scale at US$1,830-1,870 per tonne range on Monday, January 23.

As on January 20, LME official cash buyer price of aluminium stands at US$1,838.5 per tonne, cash seller & settlement price is US$1,839 per tonne, 3M buyer price is US$1,832 per tonne, 3M seller price is US$1,833 per tonne, Dec1 buyer price is US$1,860 per tonne, and Dec1 seller price is US$1,865 per tonne. The current LME official Opening Stock of aluminium is estimated at 2300375 tonnes, total Live Warrants is 1654875 tonnes, and Cancelled Warrant is 643750 tonnes.

{alcircleadd}As on January 19, LME Aluminium US Premium closing price stands at US$185, LME Aluminium West-Europe Premium is US$75, LME Aluminium East-Asia Premium is US$90, and LME Aluminium South-East Asia Premium is US$15.

In China, the benchmark price of aluminium on Shanghai Metal Exchange stands at US$1,973 per tonne on Monday, up 2.22 per cent from US$1,930 per tonne on Friday.

Base metal prices including that of aluminium has been diverging on Shanghai Futures Exchange. SMM says, “Trading sentiment in China’s domestic market is expected to low as investors gradually leave for the upcoming 2017 Chinese New Year holiday, and price divergence is expected to be continuing."

Spot aluminium in China’s domestic market is estimated to trade at discounts of RMB 160-200 per tonne on Monday.

{googleAdsense}

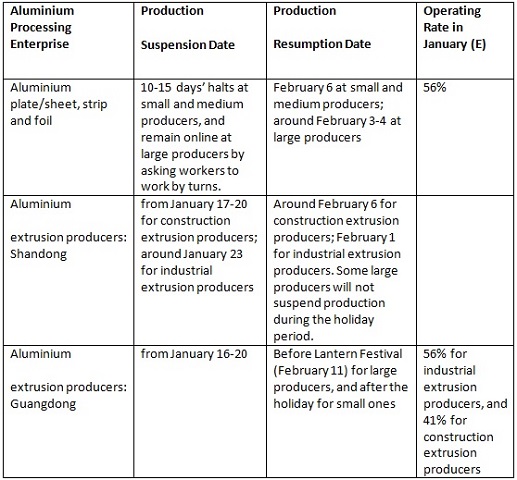

SMM updated aluminium production schedules at major processing enterprises in key regions. The schedules are as follows:

Responses