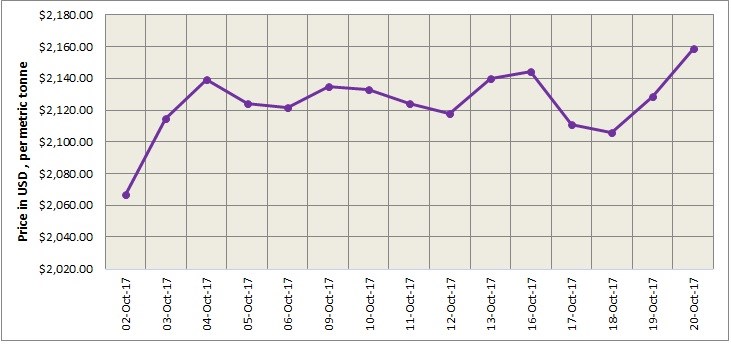

LME aluminium ended last week in a substantial rise. The light metal contract closed at US$2,159 per tonne on Friday, October 20, up from US$2,128.50 per tonne the previous day. Shanghai Metals Market predicts that LME aluminium will struggle around the moving averages and range at US$2,120-2,150 per tonne on Monday, October 21.

Reuters’ technical analysis suggests that LME aluminium is biased to decline to US$2,127 per tonne in the short term. However, any further gain will confirm the bullish price pattern and LME aluminium will revisit the highs of US$2,199 per tonne.

{alcircleadd}

As on October 20, LME official cash buyer aluminium price (Bid Price) stands at US$2,158.50 per tonne, cash seller & settlement aluminium price (Offer price) is US$2,159 per tonne, 3M Bid Price is US$2,165.50 per tonne, 3M Offer Price is US$2,166 per tonne, Dec1 Bid Price is US$2,210 per tonne, and Dec1 Offer Price is US$2,215 per tonne. LME aluminium Opening Stock or the LME aluminium inventory level stands at 1202225 tonnes, total Live Warrants is 966100 tonnes, and Cancelled Warrant is 236125 tonnes.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange has inched lower from US$2,433 per tonne on October 20, to US$2,431 per tonne on October 23.

On Friday’s night trading, base metals on Shanghai Futures Exchange registered an overall drop as dollar gained strength. The most active contract SHFE 1712 aluminium also dropped from its earlier close. SMM thinks that prices will trade within a wide range. SHFE 1712 aluminium will range at RMB 16,000-16,250 per tonne on Monday, October 23.

In China’s spot aluminium market, the spot discounts are expected to range at RMB 140-100 per tonne on Monday, SMM said

Responses