The US dollar gained against the euro, boosted by technical factors after the euro met key resistance levels, even as the greenback's outlook remained bleak amid cautious signals from the US Federal Reserve about further rate hikes. LME base metals rose for the most part while SHFE contracts ended mixed last Friday. LME aluminium fell 1% and SHFE aluminium slid 0.52%.

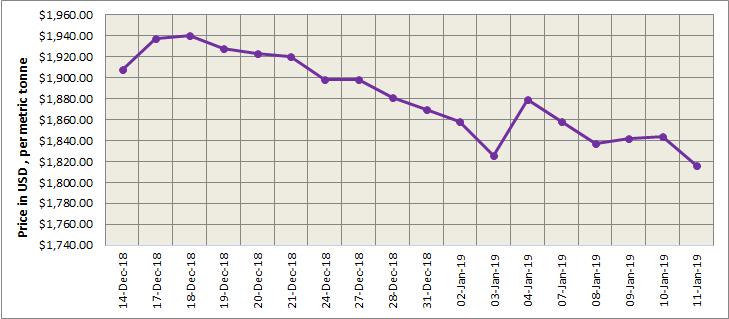

LME aluminium closed the trading at US$ 1816 per tonne last Friday. The contract came off after it rose to a high of US$1,865 per tonne overnight as shorts entered the market. It ended at US$1830.5 per tonne with open interests up 3,589 lots to 682,000 lots. We retain the view that weak fundamentals will keep prices at lows in the medium term. LME aluminium is likely to trade at US$1,805-1,845 per tonne today.

{alcircleadd}

As on January 11, LME aluminium cash (bid) price stood at US$ 1815 per tonne, LME official settlement price stands at US$ 1816 per tonne; 3-months bid price stands at US$ 1840 per tonne, 3-months offer price is US$ 1840.50 per tonne; Dec 19 bid price stands at US$ 1993 per tonne, and Dec 19 offer price stands at US$ 1998 per tonne.

The LME aluminium opening stock dropped to 1284725 tonnes. Live Warrants totalled at 1049275 tonnes, and Cancelled Warrants were 235450 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1862 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange increased to US$ 1971 per tonne today from US$ 1961 per tonne on January 10.

As shorts cut their positions, the SHFE 1903 contract rose to the day’s high of RMB 13,425 per tonne, before it relinquished those gains to close the trading day 0.3% lower at RMB 13,385 per tonne. The contract traded rangebound during the day and is expected to continue such pattern tonight. The SHFE 1902 contract also faced pressure from shorts, which dragged it to a low of RMB 13,305 per tonne. We expect the contract to trade rangebound at RMB 13,300-13,400 per tonne, with deepest spot discounts of RMB 20 per tonne.

Responses