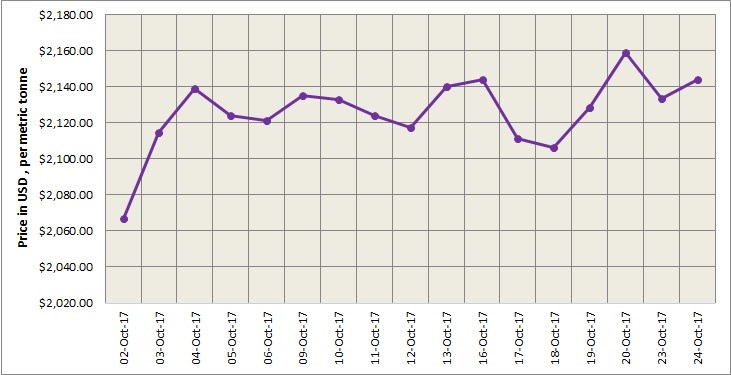

LME aluminium seems to be neutral within a wide range. The light metal contract which closed at US$2,133.5 per tonne on Monday, October 23, inched higher to close at US$2,144 per tonne on Tuesday, October 24.

Reuters’ technical analysis suggests that LME aluminium may break a resistance at US$2,171 per tonne and revisit the high of US$2,199 per tonne. There is a support at US$2,154 per tonne. A break below the level could cause a loss into the current range of US$2,127-US$2,141 per tonne in the near term. But as mentioned in previous analysis, LME aluminium price trend is biased towards an upside.

{alcircleadd}

As on October 24, LME official cash buyer aluminium price (Bid Price) stands at US$2,143.50 per tonne, cash seller & settlement aluminium price (Offer price) is US$2,144 per tonne, 3M Bid Price is US$2,144 per tonne, 3M Offer Price is US$2,155 per tonne, Dec1 Bid Price is US$2,200 per tonne, and Dec1 Offer Price is US$2,205 per tonne. LME aluminium Opening Stock or the LME aluminium inventory level stands at 1195600 tonnes, total Live Warrants is 930350 tonnes, and Cancelled Warrant is 265250 tonnes.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange has inched higher from US$2,437 per tonne on October 24, to US$2,439 per tonne on October 25.

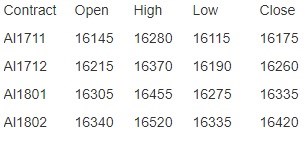

Aluminium prices at Shanghai Futures Exchange (SHFE) traded as below on Tuesday, October 24:

It is difficult for SHFE aluminium to break away from the range of moving averages without a solid direction. Market participants need to focus on inventories change, Shanghai Metals Market suggests.

Responses