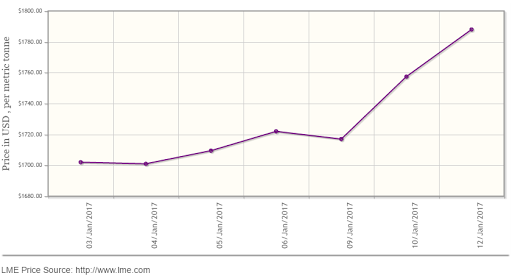

Base metal prices including aluminium are expected to be buoyed up by falling dollar on Friday, Shanghai Metals Market predicts. LME aluminium price is constantly trending higher to close at US$1,788 per tonne on January 12 and it is expected to hover within a range of US$ 1,780-1,805 per ton on Friday, January 13.

On a very positive note, LME aluminium hit the highest level in 2016 on Thursday’s night trading and relative strength index was at high. SMM predicts that LME aluminium will test USD 1,800/mt and a new market high on Friday as a result of the worry on China’s lower capacity policy of refined aluminium which is floating the market.

As on January 12, LME official cash buyer price of aluminium stands at US$ 1787 per tonne, cash seller & settlement price is US$ 1788 per tonne, 3M buyer price is US$1787 per tonne, 3M seller price is US$1,787.5, Dec1 buyer price is US$1,833 per tonne, and Dec1 seller price is US$1,838 per tonne. The current LME official Opening Stock of aluminium is estimated at 2243775 tonnes, total Live Warrants is 1601025 tonnes, and Cancelled Warrant is 647850 tonnes.

{googleAdsense}

As on January 11, LME Aluminium US Premium stands at US$180, LME Aluminium West-Europe Premium is US$75, LME Aluminium East-Asia Premium is US$90 and LME Aluminium South-East Asia Premium is US$15.

It was rumoured on Thursday’s afternoon that Henan, Shandong and Shanxi provinces plan to cut aluminium capacities by 30 per cent, and reduce alumina capacities by 50 per cent. However, as SMM confirms, the three provinces have not released any official statement on capacity cuts.

SHFE 1703 aluminium opened higher during Thursday’s night trading finally closed up by 2.47 per cent. According to SMM, market players, who are not familiar with industrial characteristics of refined aluminium, are worried about the acceleration of capacity cut, raising market optimistic sentiment. Aluminium traded on Shanghai Futures Exchange is predicted to hover at a high range of RMB 13,400-13,600/mt on Friday.

Spot aluminium in China’s domestic market is estimated to trade at discounts of RMB 180-140/mt on Friday.

Key Macroeconomic indicators ( SMM)

China’s December trade data, annualized imports and exports in December, US annualized December PPI and US December retail and core retail sales will be announced today. Trump’s speech shed no lights on economic policy, hurting the US dollar. Uncertainty over Fed’s rate hikes increased due to mixed attitude of St . Louis Fed Chair James Bullard and Philadelphia Fed Chair Patrick Harker. The US dollar will remain weak before more detailed policies by Trump are released. SHFE copper and SHFE aluminium will remain strong, while other base metals will diverge.

Responses