The US dollar held onto three-week highs against a basket of its rivals on Friday, supported by quarter-end rebalancing flows and after the release of mixed economic data. LME base metals closed mixed on Friday. LME aluminium inched up 0.1%, while SHFE aluminium shed 0.3%.

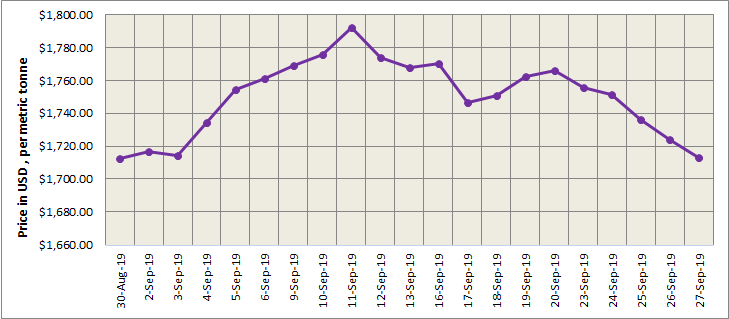

Three-month LME aluminium recovered from a low of US$1,721.5 per tonne and finished 0.12% higher at US$1,741 per tonne on Friday night. The contract continued to pare losses from the previous week and is likely to trade at US$1,730-1,780 per tonne today.

{alcircleadd}

As on September 27, Friday, LME aluminium cash (bid) price stood at US$ 1712 per tonne, LME official settlement price stands at US$ 1713 per tonne; 3-months bid price stands at US$ 1733 per tonne, 3-months offer price is US$ 1733.50 per tonne; Dec 20 bid price stands at US$ 1813 per tonne, and Dec 20 offer price stands at US$ 1818 per tonne.

The LME aluminium opening stock increased to 914725 tonnes. Live Warrants totalled at 735525 tonnes, and Cancelled Warrants were 179200 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1742 per tonne.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE (Shanghai Future Exchange) stands at USD 2035 per tonne today, 30 September 2019.

The most-active SHFE November contract came off after climbed as intensified risk aversion before holiday drove longs to exit. It finished the trading day on Friday some 0.7% lower at RMB 13,975 per tonne. The November contract then ended down 0.32% at RMB 13,925 per tonne during Friday night, regaining losses after slipped to a low of RMB 13,888 per tonne. Avoidance of risk-taking at the pre-holiday season will see the contract hovering between RMB 13,750-14,000 per tonne today.

Responses