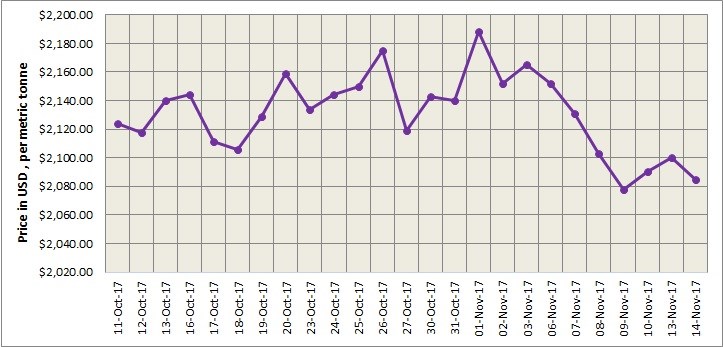

LME aluminium is struggling to break above the US$2,100 per tonne mark. After inching higher at US$2,100 per tonne on Monday, November 13, the light metal contract again dropped to US$2,085 per tonne on Tuesday, November 14. Current price trend analysis suggests that LME aluminium will extend its downtrend in the near term. Any gain in this period will be limited in a narrow range.

As on November 14, LME official cash buyer aluminium price (Bid Price) stands at US$2,084.50 per tonne, cash seller & settlement aluminium price (Offer price) is US$2,085 per tonne, 3M Bid Price is US$2,105 per tonne, 3M Offer Price is US$2,105.50 per tonne, Dec1 Bid Price is US$2,150 per tonne, and Dec1 Offer Price is US$2,155 per tonne. LME aluminium Opening Stock or the LME aluminium inventory level stands at 1161275 tonnes, total Live Warrants is 912375 tonnes, and Cancelled Warrant is 248900 tonnes.

As on November 14, spot price against 3-month futures price traded at discount of US$21 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange has dropped further from US$2,307 per tonne on November 14, to US$2,292 per tonne on November 15.

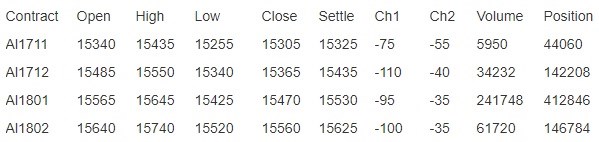

In China domestic market, aluminium price is keeping volatile. The latest price movement on Shanghai Futures Exchange as on November 14 is as follows:

Source: www.metal.com

Shanghai Metals Market suggests that the market needs to focus on struggle between bears and bulls at RMB 15,500 per tonne for SHFE aluminium. It maintain views of downward tendency for aluminium price in the near term.

Responses