Benchmark aluminium price on London Metal Exchange slipped US$6 per tonne lower on Tuesday, February 13, as LME aluminium inventory grew significantly to 1.28 million tonnes. The light metal contract closed at US$2,123.50 per tonne yesterday, down from US$2,129.50 per tonne on Monday, February 12.

Shanghai Metals Market forecasts that LME aluminium will trade at US$2,120-2,155 per tonne on Wednesday, February 14 with persisting pressure at the five-day and 10-day moving averages.

{alcircleadd}

As on February 13, LME official cash buyer aluminium price (Bid Price) stands at US$2,122.50 per tonne, cash seller & settlement aluminium price (Offer price) is US$2,123.50 per tonne, 3M Bid Price is US$2,133 per tonne, 3M Offer Price is US$2,133.50 per tonne, Dec1 Bid Price is US$2,183 per tonne, and Dec1 Offer Price is US$2,188 per tonne. LME aluminium opening stock stands at 1275500 tonnes, total Live Warrants is 1065975 tonnes, and Cancelled Warrants total at 209525 tonnes.

LME aluminium Asian reference price three-months ABR is given asUS$2,146.82 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange has dropped from US$2,216 per tonne on February 13 to US$2,213 per tonne on February 14.

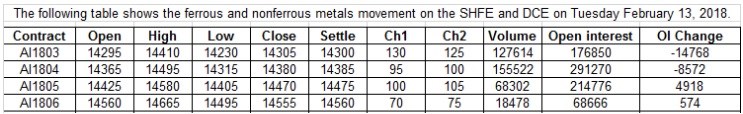

On Shanghai Futures Exchange, aluminium met resistance at RMB 14,500 per tonne as it struggled to move up during the day’s trading hours. The movement of the contract as updated by SMM was as follows:

SMM thinks support is there for SHFE aluminium at the five-day and 10-day moving averages. The contract is expected to trade at RMB 14,300-14,450 per tonne range on Wednesday, February 14.

Discounts on spot aluminium are likely to be RMB 260-220 per tonne today, SMM said.

Responses