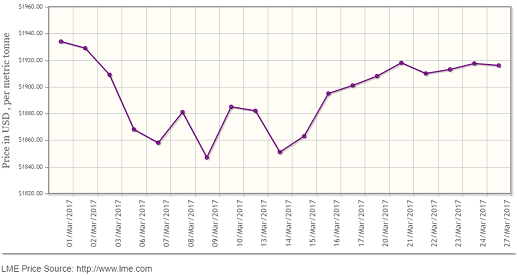

LME aluminium dipped marginally after meeting resistance at US$1,940 per tonne. The contract moved below the 5-day moving average to close at US$1,916 per tonne on Monday, March 27. The previous closing was recorded at US$1,917 per tonne. Shanghai Metals Market (SMM) estimates LME aluminium will test support at the 10-day moving average and move higher between US$1,920-1,935 per tonne on Tuesday, March 28.

As on March 27, LME official cash buyer price of aluminium stands at US$1,917 per tonne, cash seller & settlement price is US$1,915 per tonne, 3M buyer price is US$1,924 per tonne, 3M seller price is US$1,924.50 per tonne, Dec1 buyer price is US$1,958 per tonne, and Dec1 seller price is US$1,963 per tonne. The current LME official Opening Stock of aluminium is estimated at 1936275 tonnes, total Live Warrants is 1056125 tonnes, and Cancelled Warrant is 880150 tonnes.

{alcircleadd}

As on March 24, LME Aluminium US Premium remains unchanged at US$215, LME Aluminium West-Europe Premium stands at US$95, LME Aluminium East-Asia Premium is US$100 and LME Aluminium South-East Asia Premium is US$15 (per tonne).

The benchmark price of aluminium has also dropped on Shanghai Metal Exchange (SME). As on March 28, the price stands at US$1,950 per tonne, down 0.45 per cent from the previous day's price of US$1,959 per tonne.

{googleAdsense}

SHFE 1705 aluminium traded on Shanghai Futures Exchange (SHFE) opened at RMB 13,710 per tonne on Monday and then edged marginally up to close at RMB 13,715 per tonne. As per SMM forecast, the contract is estimated test support at the 60-day moving average and fall between RMB 13,550-13,750 per tonne on Tuesday.

Spot aluminium in China's domestic market should trade at discounts of RMB 170-130 per tonne on Tuesday, says SMM.

The US wholesale and retail inventories in February, annualized home price index at 20 global cities and Conference Board’s March CCI will be released today. The market participants are advised to keep an eye on these data. Base metals which dipped marginally from their recent highs are expected to keep diverging in the short term.

Responses