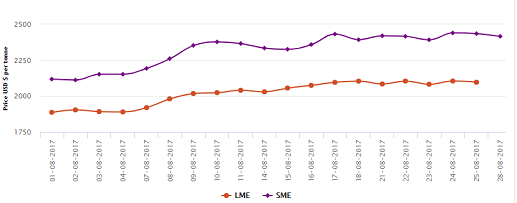

LME aluminium corrected down from the highs of US$2,105 per tonne on Thursday, August 24, to US$2,096.50 per tonne on Friday, August 25. Though the correction, analysts say, is reasonable following the huge price gains, it is likely to give in to a wide-range trading in the short term. According to Shanghai Metals Market forecast, LME aluminium will fluctuate widely around its 5-day moving average in the range of US$2,050-2,085 per tonne on Monday, August 28.

As on August 25, LME official cash buyer aluminium price (Bid

Price) stands at US$2,095.50 per tonne, cash seller & settlement aluminium

price (Offer price) is US$2,096.50 per tonne, 3M Bid Price is US$2,097 per

tonne, 3M Offer Price is US$2,099 per tonne, Dec1 Bid Price is US$2,137 per

tonne, and Dec1 Offer Price is US$2,142 per tonne. LME aluminium Opening Stock

stands at 1321600 tonnes, total Live Warrants is 1132175 tonnes, and Cancelled

Warrant is 189425 tonnes.

SME and SHFE

Aluminium Price Trend

The benchmark aluminium price at Shanghai Metal Exchange

(SME) has dropped slightly from US$2,435 per tonne on Friday, August 25 to US$2,416

per tonne on Monday, August 28.

At Shanghai Futures Exchange (SHFE), base metals registered

declines on Friday’s night trading. This is just the beginning of the aluminium

price cycle. SMM says that SHFE aluminium prices will fluctuate at highs after

the drop and range at RMB 16,150-16,450 per tonne on Monday, August 28.

In China aluminium spot market, prices are expected to rise

in the range of RMB 18,000-20,000 per tonne in the second half of 2017. Spot discounts

over SHFE 1709 aluminium are expected to range at RMB 220-180 per tonne on Monday.

The market lacks any important data release or news today.

Right now, focus will be on the US wholesale inventories in July and the US

dollar index movement on Monday, August 28, SMM said.

Responses