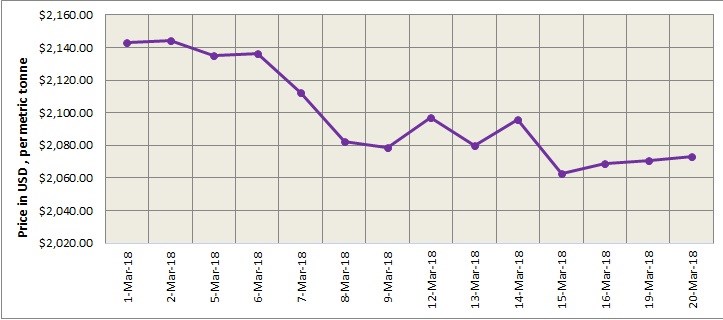

Benchmark aluminium price on London Metal Exchange increased further to close at US$2073 per tonne on Tuesday, March 20, up from the previous day’s close at US$2070.5 per tonne. LME aluminium continued to consolidate and is expected to trade at US$2,070-2,095 per tonne today, according to SMM. The Federal Reserve’s decision on an interest rate hike will give more guidance to the market.

As on March 20, LME aluminium cash (bid) price stands at US$ 2072 per tonne, LME official settlement price stands at US$ 2073 per tonne; 3-months bid price stands at US$ 2093 per tonne, 3-months offer price is US$ 2093.50 per tonne; Dec 19 bid price stands at US$ 2142 per tonne, and Dec 19 offer price is US$ 2147 per tonne.

The LME aluminium opening stock has dropped to 1288675 tonnes. Live Warrants totalled at 1049625 tonnes, and Cancelled Warrants were 239050 tonne.

LME aluminium 3-months ABR price is hovering at US$ 2091 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange declined from US$ 2178 per tonne on March 20 to US$ 2165 per tonne on March 21.

SMM expects SHFE aluminium to trade at RMB 13,900-14,050 per tonne today. Spot discounts are seen at RMB 160-120 per tonne. Investors will take guidance from changes in inventory in the short term.

The US dollar is likely to remain rangebound at current levels as the market expects higher interest rates. With pressure from the US dollar, base metals are likely to remain weak in the short term.

Responses