LME aluminium has stopped declining. After trending downwards for the last four consecutive days, the light metal finally rose 0.5 per cent to touch US2,002 per tonne on Monday, December 11. However, after night trading, the contract dropped slightly to close at US$1,991.5 per tonne. Technical analysis suggests that LME aluminium may break the five-day moving average on Tuesday, December 12, to trade in the range of US$2,015-2,045 per tonne.

As on December 11, LME official cash buyer aluminium price (Bid Price) stands at US$1,990.50 per tonne, cash seller & settlement aluminium price (Offer price) is US$1,991.50 per tonne, 3M Bid Price is US$2,005 per tonne, 3M Offer Price is US$2,006 per tonne, Dec1 Bid Price is US$2,055 per tonne, and Dec1 Offer Price is US$2,060 per tonne. LME aluminium Opening Stock or the LME aluminium inventory level stands at 1097425 tonnes, total Live Warrants is 871425 tonnes, and Cancelled Warrant is 226000 tonnes.

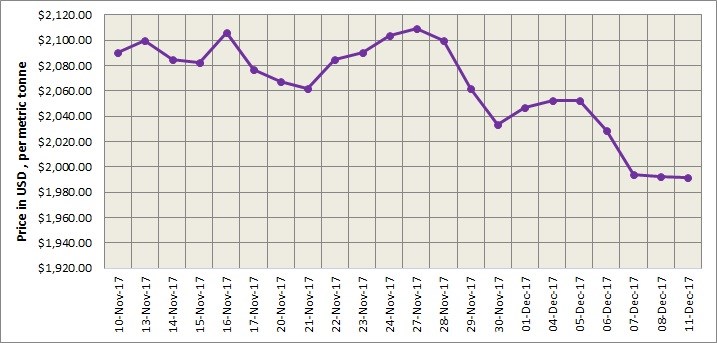

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange has slipped from US$2,109 per tonne on December 11 to US$2,100 per tonne on December 12.

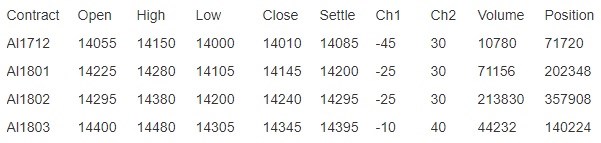

The price movement of SHFE aluminium on December 11 as updated by SMM was as follows:

SHFE aluminium faced resistance as it dropped yesterday. Analysts opine that the bears may close out for settlement before the year ends. SHFE aluminium is estimated to keep weak and volatile in the near term. Spot premium will remain at discount of RMB 150-110 per tonne.

Responses