您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

The US dollar index dipped to 95.63, the lowest since October 12, 2018, pressured by growing expectations the US Federal Reserve could stop its interest rate hike cycle. Slower-than-expected growth in the US services sector also weighed on the greenback. Base metals increased for the most part as LME aluminium went up 0.54%. SHFE aluminium edged down.

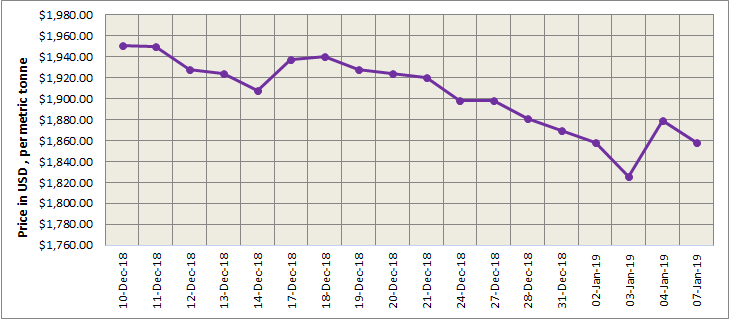

LME aluminium contract closed Monday’s trading at US$ 1858 per tonne. Limited upward momentum ended LME aluminium at US$1,878 per tonne, after it rallied to a high of US$1,885 per tonne and consolidated above the daily moving average. It is likely to trade at US$1,855-1,888 per tonne today.

{alcircleadd}

As on January 7, LME aluminium cash (bid) price stood at US$ 1857.50 per tonne, LME official settlement price stands at US$ 1858 per tonne; 3-months bid price stands at US$ 1873.50 per tonne, 3-months offer price is US$ 1874 per tonne; Dec 19 bid price stands at US$ 2030 per tonne, and Dec 19 offer price stands at US$ 2035 per tonne.

The LME aluminium opening stock decreased slightly to 1276050 tonnes. Live Warrants totalled at 1035350 tonnes, and Cancelled Warrants were 240700 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1875 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange dropped to US$ 1941 per tonne today from US$ 1946 per tonne on January 7.

The SHFE 1903 contract faced resistance at the five-day moving average, and closed at RMB13,465 per tonne after it rose to a high of RMB13490 per tonne overnight. Spot discounts are set at RMB50-10 per tonne. Shanghai Metals Market expects the contract to trade at RMB13,380-13,480 per tonne.

Responses