The US dollar index dipped on Friday as stocks traded higher after a week of price swings. LME base metals traded mixed on Friday and aluminium dropped 0.7%. SHFE base metals also saw mixed performance and aluminium plunged 0.9%. The SHFE was closed overnight for the New Year's Day holiday.

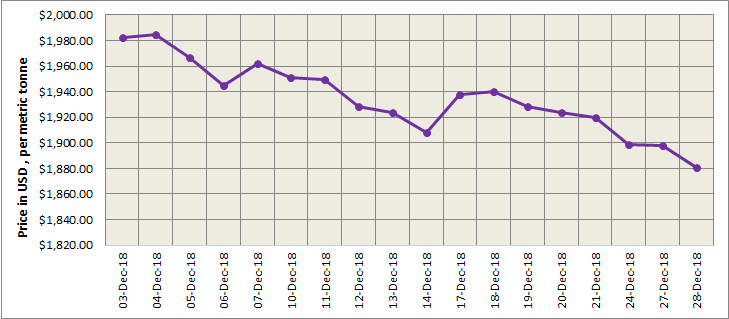

LME aluminium closed Friday’s trading at US$ 1881 per tonne, down from Thursday, December 27. The contract might show some gain during today’s trading before the New Year’s Day holiday on 1st.

{alcircleadd}

As on December 28, LME aluminium cash (bid) price stood at US$ 1880 per tonne, LME official settlement price stands at US$ 1881 per tonne; 3-months bid price stands at US$ 1856.50 per tonne, 3-months offer price is US$ 1857 per tonne; Dec 19 bid price stands at US$ 1930 per tonne, and Dec 19 offer price stands at US$ 1935 per tonne.

The LME aluminium opening stock increased slightly to 1267125 tonnes. Live Warrants totalled at 1026950 tonnes, and Cancelled Warrants were 240175 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1873 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange closed the week low at US$ 1966 per tonne on Friday. Pressure above at the 60-day moving average kept the SHFE 1902 contract around RMB 13,605 per tonne on Friday December 28. After it twice rose to an intraday high of RMB 13,625 per tonne, it dipped and settled at RMB 13,590 per tonne, marking the third consecutive day of decline. Falling prices of alumina and weak demand are likely to cap any increase in aluminium prices this week.

For New Year's Day, china market will remain closed from December 30, 2018 to January 1, 2019.

Responses