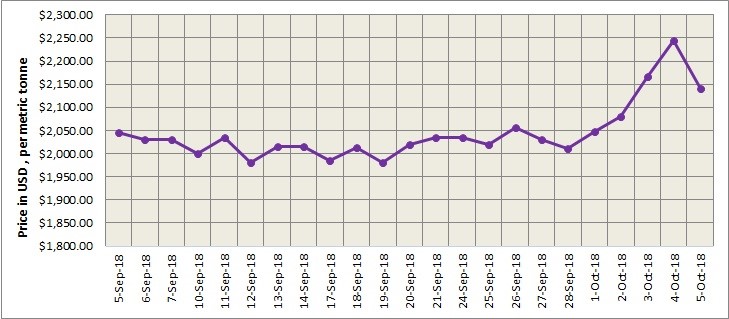

LME aluminium started the week and the month of October with a gain. Benchmark aluminium price on London Metal Exchange gained significantly to close at US$ 2047.50 per tonne on Monday October 1. LME aluminium prices climbed more than 4 per cent and to their highest in nearly five weeks on Wednesday October 4 after the news broke that Norsk Hydro would halt production at its Alunorte alumina refinery in Brazil as the bauxite residue deposit area 1 (DRS1) is almost in its full capacity, due to the ban on using the press filter and the newly developed bauxite residue deposit area (DRS2). This generated fear of alumina supply disruption in a market that was already tight.

The aluminium cash contract closed at US$ 2243.50 per tonne on October 4, the highest in the week. After reaching the highest, the contract then fell and closed the week at US$ 2140 per tonne on Friday October 5, as the fear of complete closure of the refinery started easing down on the news that IBAMA authorises Alunorte to utilize bauxite residue press filter as first step to resume 50% operations.

Aluminium inventories in London Metal Exchange have been falling at an unforeseen speed. The LME aluminium opening stock continued dropping to stand at 966,900 tonnes. LME on-warrant aluminium stocks, metal not earmarked for delivery, are currently at their lowest since January 2006 at 605,650 tonnes. Though analysts are suspicious about whether the fall is as much to do with the exchange’s warehousing function as with market reality, it is also apparent that the aluminium prices have limited downroom in the short and medium term, as the warehouse is emptying fast and input costs are under pressure.

LME aluminium 3-months Asian Reference Price is hovering at US$ 2181 per tonne.

Shanghai Future Exchange and Shanghai Metal Exchange remained closed from Monday October 1 to Sunday October 7 for the National Day holiday; hereby no trading and price updates could be available on the China market.

Responses