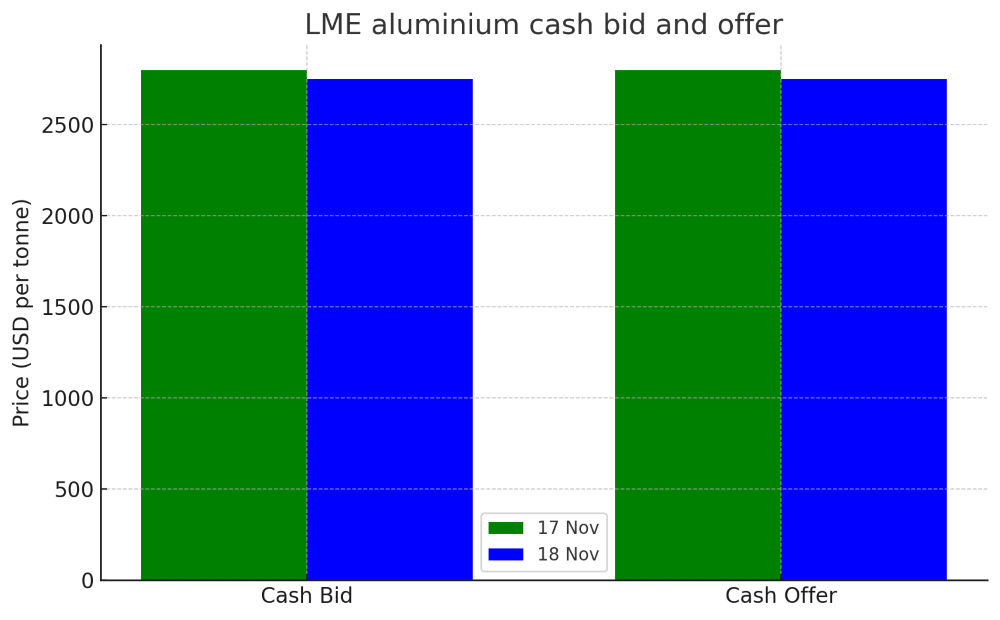

The declining trend concerning the London Metal Exchange (LME) aluminium price continued on November 18, 2025.

The LME aluminium cash bid shifted from USD 2,797.5 per tonne to USD 2,748.5 per tonne, indicating a decline of USD 49 per tonne or 1.8 per cent. Similarly, the cash offer moved from USD 2,798 per tonne to USD 2,749.5 per tonne, suggesting a slip of USD 48.5 per tonne or 1.73 per cent.

The declining trend was observed in the LME 3-month bid and offer price, where the bid declined by USD 48 per tonne or 1.7 per cent to reach USD 2,785 per tonne. The 3-month offer inched down by USD 47 per tonne or 1.6 per cent and is currently at USD 2,787 per tonne on November 18.

Explore- Most accurate data to drive business decisions with 50+ reports across the value chain

Both the December 26 bid and offer price declined by USD 42 per tonne or 1.5 per cent, where on November 18, the bid settled at USD 2,825 per tonne and the offer at USD 2,830 per tonne.

The LME’s three-month Asian Reference Price on November 18 stood at USD 2,780 per tonne. Indicating a decrease of USD 33.5 per tonne or 1.2 per cent.

At the inventory front, the opening stock moved from 550,200 tonnes to 548,075 tonnes, reflecting a downward movement of 2,125 tonnes or 0.4 per cent. The live warrants also changed from 522,800 tonnes to 522,225 tonnes, down by 575 tonnes or 0.1 per cent. Concurrently, the cancelled warrants dropped from 27,400 tonnes to 25,850 tonnes, representing a slip of 1,550 tonnes or 5.7 per cent.

LME alumina Platts price stood at USD 318.75 per tonne.

Explore our B2B marketplace - AL Biz

Responses