Leading American manufacturer and supplier Kaiser Aluminium has downgraded itself from a “buy” rating to a “hold” rating, according to a research note released on Monday. The move comes despite JPMorgan Chase & Co. recently raising its price target for the stock from USD 64 to USD 82 and assigning a “neutral” rating on July 28.

Currently, one equities research analyst maintains a “buy” recommendation, while two others have rated the stock as “hold”. Data from MarketBeat shows Kaiser Aluminium carries a consensus rating of “Hold” with an average price target of USD 78.00.

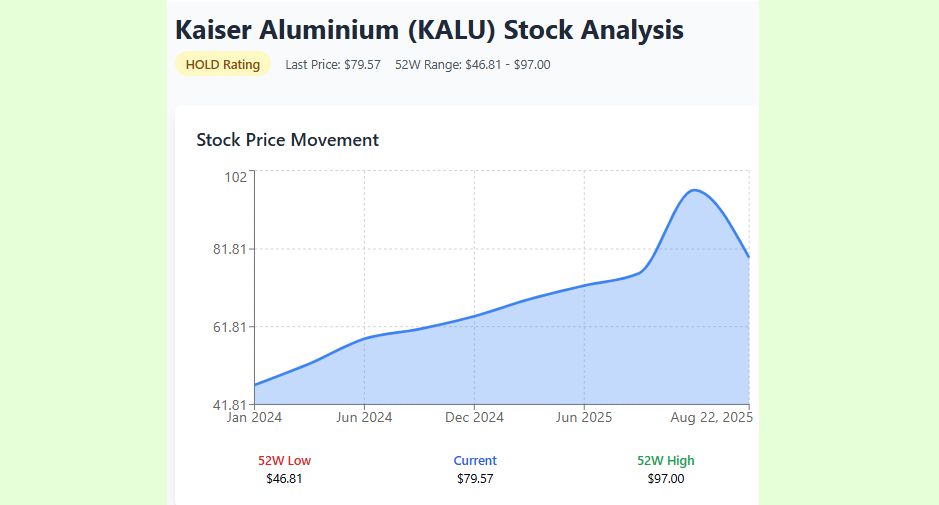

Share price movement

The final day of trading before the downgrade was August 22, 2025, wherein Kaiser Aluminium closed at USD 79.57, which was an increase of 5 per cent. There was no trading on August 25, which was a Monday, likely due to the market closure.

It has been a volatile 52 weeks for Kaiser Aluminium, trading between a low of USD 46.81 and a high of USD 97.00. The company has a market cap of USD 1.29 billion with a P/E ratio of 20.46 and a beta of 1.51, indicating that the stock is somewhat more volatile than the market overall.

Strong Q2 earnings

The company’s momentum is partly fuelled by robust Q2 2025 results. On July 23, Kaiser Aluminium reported earnings per share (EPS) of USD 1.21, handily beating the Zacks Consensus Estimate of USD 0.49. Revenue came in at USD 823.10 million, above expectations of USD 786.70 million. Return on equity was recorded at 8.03 per cent, with a net margin of 2.05 per cent.

This outperformance led to a surge in investor confidence, propelling the stock to its new 52-week high of USD 97.00 on July 24, representing a 34.9 per cent year-to-date gain and a dramatic recovery from 2024’s low of approximately USD 46.81.

Investor confidence anchored by dividends

According to InvestingPro, Kaiser Aluminium has demonstrated a one-year performance gain of 18.68 per cent, underpinned by 19 consecutive years of dividend payouts and a current yield of 3.3 per cent. With a price-to-earnings ratio of 29.45, however, the stock is trading above its estimated fair value, a factor that may have influenced the cautious downgrade from Wall Street Zen.

Institutional positioning

Institutional investors continue to play an active role in shaping Kaiser Aluminium’s shareholder base. State Street Corp raised its holdings by 31.9 per cent in Q2, now owning over 1.15 million shares valued at USD 92.24 million. Other large holders include Dimensional Fund Advisors, American Century Companies, and Wellington Management Group, collectively representing over 99 per cent of institutional ownership.

Balancing growth with valuation risks

While Kaiser Aluminium's fundamentals remain strong with steady demand from aerospace, automotive, and packaging sectors, the current valuation appears expensive, relative to earnings potential. The downgrade to "hold" emphasises the thin line between strong operational performance and investor caution around price.

Responses