您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

Indian multinational conglomerate JSW Group is poised to establish electric vehicle and battery manufacturing initiatives in Odisha, an eastern state, with an investment totalling around INR 400 billion (approx. $4.82 billion).

The JSW Group

The JSW Group, valued at US$ 23 billion, stands as one of India's foremost business conglomerates. Through its dynamic and sustainable ventures across industries such as steel, energy, infrastructure, cement, paints, venture capital, and sports, JSW Group is significantly contributing to India's economic advancement.

JSW and Odisha State Govt. signed MoU

On February 11, 2024, the company and the state government officially and jointly announced that they had inked a memorandum of understanding (MoU) to set up an Integrated Electric Vehicles (EV) and EV Battery Manufacturing Project across two cities.

In November, JSW Group joined hands with China's SAIC Motor to establish a joint venture in India, prioritising green mobility and the advancement of the electric vehicle (EV) ecosystem. JSW Group's strategic projects in Odisha will compete with both local and international players in India's burgeoning EV market.

Although electric models constituted approximately 2 per cent of India's car sales last year, Tata Motors held a significant market share. However, the government aims to achieve a 30 per cent share by 2023.

What AL Circle’s “Global Aluminium Industry Outlook 2024” says

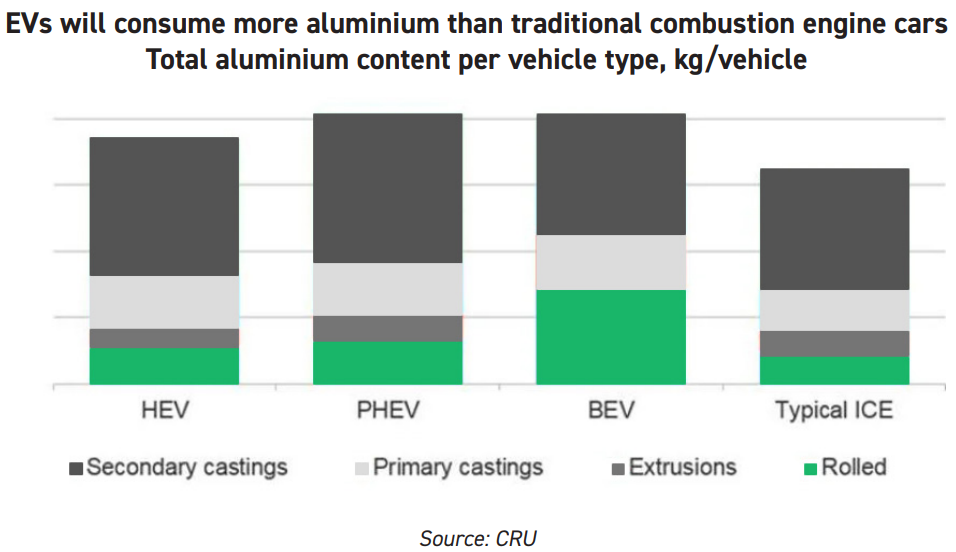

The transportation sector will largely drive aluminium demand, with EVs playing a major role. The demand for aluminium in the automotive industry is expected to surge by 15-27 per cent, driven by the growing prevalence of electric vehicles (EVs). In comparison to traditional internal combustion engine cars, plug-in hybrid and full battery electric vehicles utilize 25-27 per cent more aluminium, with a baseline of 160 kg per vehicle in internal combustion engines.

While the rise in aluminium usage in traditional cars is mainly attributed to the weight reduction benefits, the surge in aluminium demand for EVs is equally influenced by innovative applications beyond the use of aluminium body sheets. This shift highlights a broader transformation in the automotive industry as it adapts to the unique requirements of electric vehicle technology.

EV production and sales in China can be attributed to robust government policies and incentives aimed at both manufacturers and consumers. Consequently, China has positioned itself as a frontrunner in the EV market, capturing around 60 per cent of global electric car sales in 2022. Remarkably, more than half of the electric cars worldwide are now on Chinese roads, and the country has already surpassed its 2025 target of achieving a 20 per cent share in new energy vehicle sales, as the International Energy Agency reported. With the continuing growth in EV demand, the demand for metals, including aluminium, used in their production is expected to rise, indicating a positive outlook for the aluminium industry.

Responses