您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

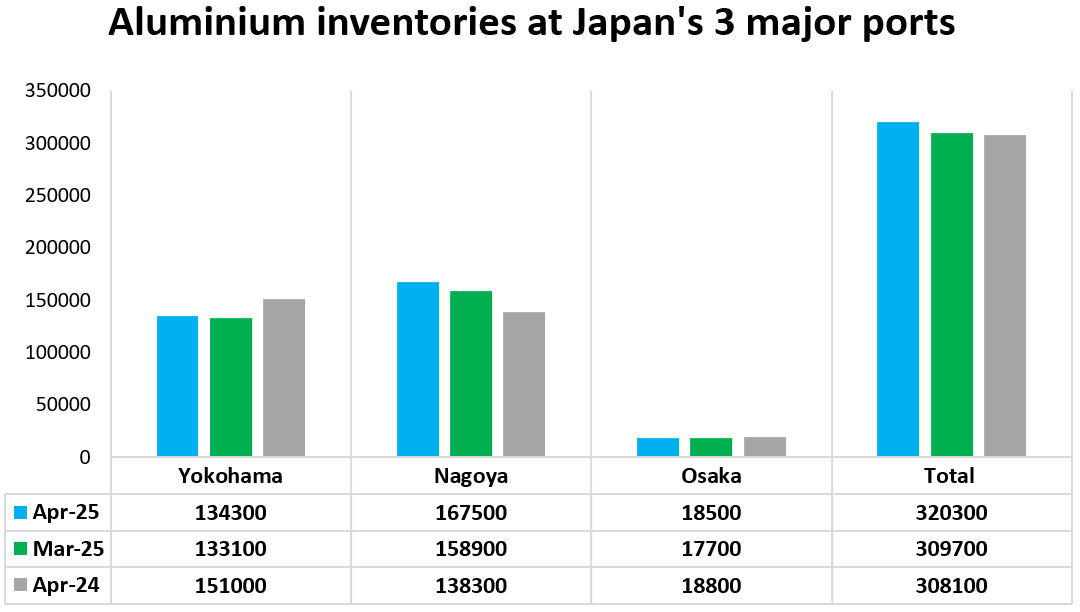

As of the end of April 2025, aluminium inventories at Japan’s three major ports — Yokohama, Nagoya and Osaka — have reached 320,300 tonnes, up 3.4 per cent from March’s 309,700 tonnes, according to Marubeni Corp data. In parallel, as disclosed previously, the import premium for primary aluminium shipments into Japan plunged 20 per cent quarter-on-quarter to USD 182 per tonne in Q2 2025, the first quarterly decline in five quarters, based on nine trades concluded between March 24-27, as reported by S&P Global Platts and Reuters sources.

Meanwhile, domestic consumption fell 3.3 per cent to 3.35 million tonnes in the January-November 2024 period. Building sector demand slid 7.7 per cent to under 350,000 tonnes, and automotive usage dropped 4.1 per cent to 1.45 million tonnes, per Japan Aluminium Association figures reported by Argus Media.

Aluminium stocks at Yokohama rose to 134,300 tonnes in April from 133,100 tonnes in March, Nagoya inventories jumped to 167,500 tonnes from 158,900 tonnes, and Osaka holdings increased to 18,500 tonnes from 17,700 tonnes, bringing the total to 320,300 tonnes. This 3.4 per cent month-on-month gain reverses a 1.2 per cent decline recorded in March, when total stocks dipped to 309,700 tonnes.

The aluminium inventory levels at Japan’s three primary ports present a mixed year-on-year (Y-o-Y) picture for April 2025. According to the latest data, the total aluminium stock across these ports stood at 320,300 tonnes at the end of April 2025, representing a 3.95 per cent increase from 308,100 tonnes recorded in April 2024.

Nagoya Port has shown the most pronounced Y-o-Y growth. Inventories rose from 138,300 tonnes in April 2024 to 167,500 tonnes in April 2025, marking an impressive 21.1 per cent increase. This surge reinforces Nagoya’s growing role as a primary aluminium intake and distribution centre, likely driven by strategic shipments from countries like India and the UAE that have stepped in to fill the vacuum created by reduced Russian supply.

On the other hand, Yokohama Port witnessed a decline in stock levels over the same period. Aluminium inventories dropped from 151,000 tonnes in April 2024 to 134,300 tonnes in April 2025, a 11 per cent contraction. This drop is likely a redistribution of cargo volumes or drawdowns to meet regional demand closer to end-user industries.

…and so much more!

SIGN UP / LOGINResponses