According to China customs data, China’s domestic primary aluminium imports during the first two months of 2024 amounted to 472,000 tonnes, encountering a year-on-year surge of 214.7 per cent.

The primary import sources were Russia, India, Indonesia, China, Malaysia, the United Arab Emirates, and others. Among them, Russia was the highest exporter, supplying 277,000 tonnes in two months, accounting for 58.7 per cent of China’s total imports. On an annual basis, the import volume recorded an increase of 163.2 per cent.

The import volume from Russia stood at approximately 161,800 tonnes and 115,400 tonnes each month. In January, the imports increased by 299.6 per cent year-on-year and 34.4 per cent month over month, accounting for 65.3 percent of the total.

From India, China’s primary aluminium imports were approximately 38,200 tonnes in January, accounting for 15.4 per cent of the total imports. On a month-on-month calculation, the imports skyrocketed by 336.2 per cent, while on an annual basis, they inflated by 172.2 per cent.

India’s exports in February reflected a skyrocketing growth of 6512.2 per cent year-on-year but a decline of 30.5 per cent month-on-month, amounting to 26,500 tonnes.

The imports from Indonesia were 22,100 tonnes in January, accounting for 8.9 per cent of the total imports, up by 103.7 per cent month-on-month.

China’s primary aluminium import window was open for a long time, especially in January, resulting in metal inflow from several countries into China. Therefore, although the total amount of primary aluminium imports from Russia increased substantially, its proportion was lower.

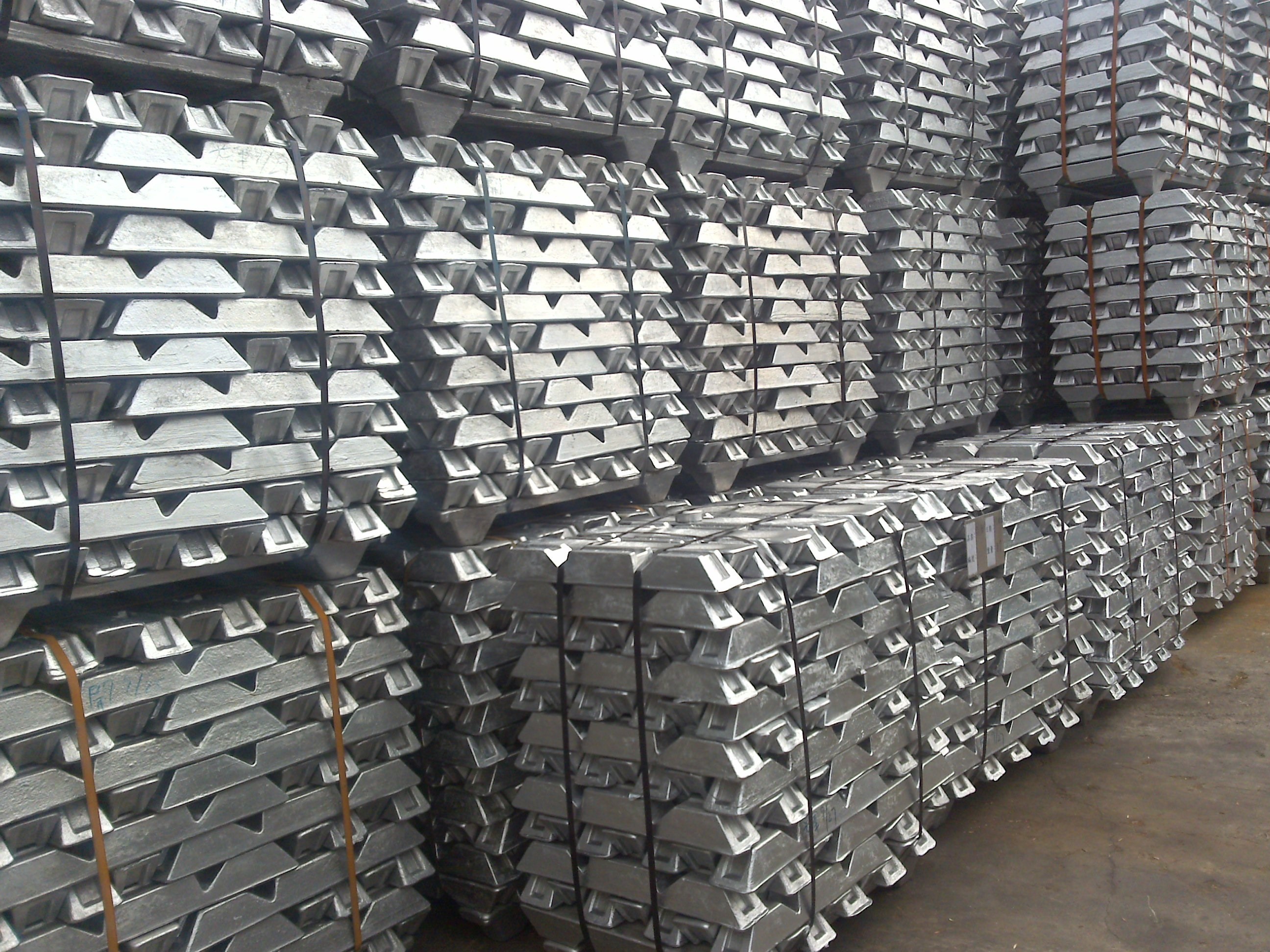

Domestic primary aluminium imports mainly flowed in through general trade, with import volume accounting for 66.64 per cent of the total. The large amount of primary aluminium imported into China had an impact on the domestic primary aluminium market, including domestic aluminium ingot inventory. China’s social primary aluminium inventory accumulation slowed down but did not register a drop, given the increase in primary aluminium imports.

However, due to the close of the primary aluminium import window and the resumption of domestic primary aluminium production capacity in Yunnan, the amount of imported primary aluminium may slightly decrease in March.

Responses