Aluminium industry leaders say the United States is unwittingly ‘leaking’ a strategic resource by exporting vast quantities of scrap metal even as domestic makers scramble for feedstock. The Aluminum Association’s new “Scrap The Exports” campaign notes that the US currently exports roughly 2 million tonnes of aluminium scrap each year, nearly half of what the country recycles.

Image source: https://www.aluminum.org/

Image source: https://www.aluminum.org/

Explore- Most accurate data to drive business decisions with 50+ reports across the value chain

“Scrap aluminium is a vital feedstock for American manufacturers, especially at a time when US aluminium firms are investing and need reliable and affordable access to metal like never before,” says Charles Johnson, president and CEO of the Aluminum Association (AA). By losing high-grade scrap, US companies contend, the nation cedes raw material that could otherwise be used in domestic factories – handing an advantage to foreign competitors like China.

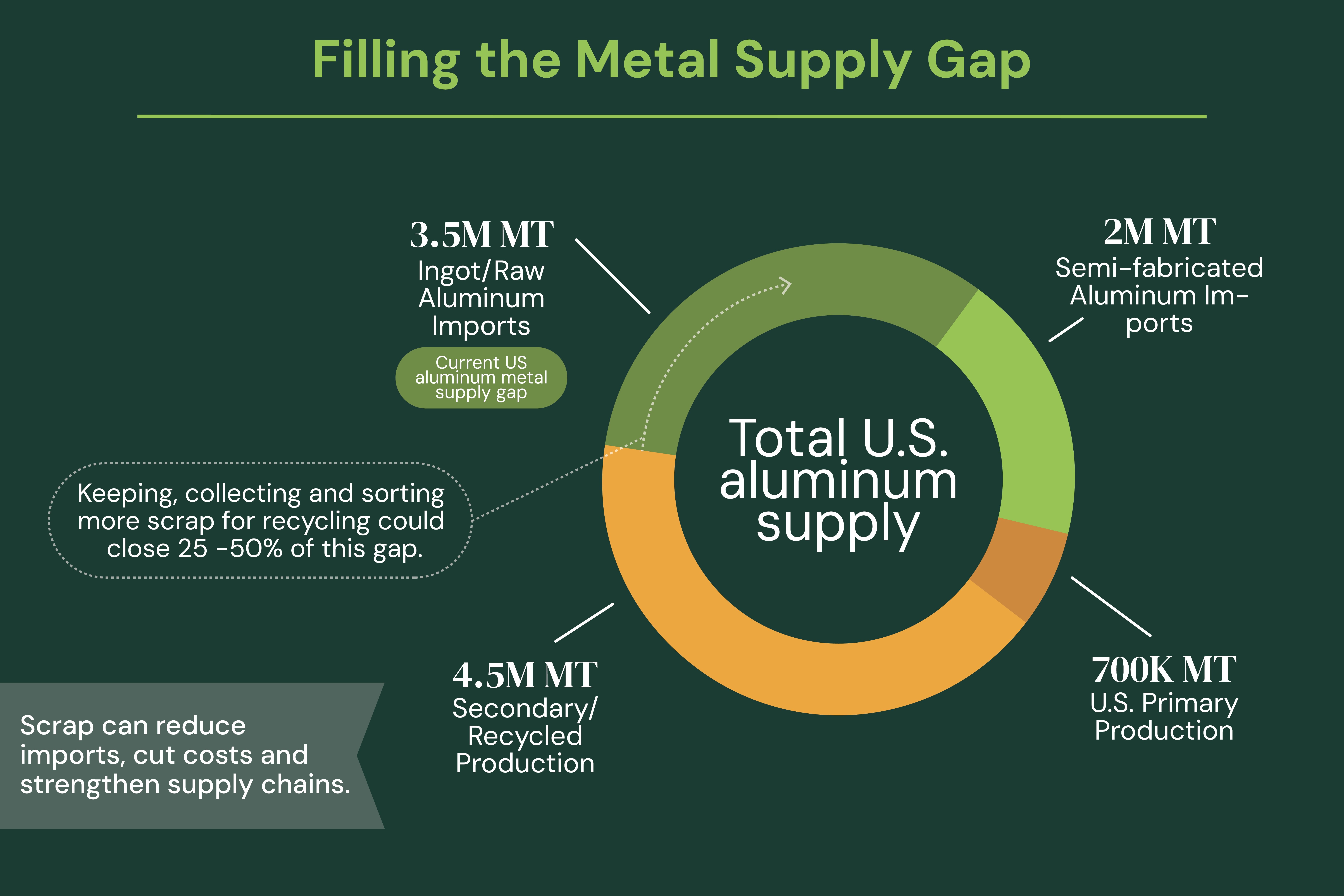

Domestic scrap flow and supply gaps

As the US aluminium industry depends overwhelmingly on recycled metal, about 85 per cent of US aluminium production today uses scrap, even as a big share of that scrap heads abroad.

In 2024, the United States generated roughly 7.6 million tonnes of aluminium scrap and used about 5.6 million tonnes domestically, while 2.0 million tonnes (24 per cent) were shipped overseas. Much of that export consists of clean, mill-ready scrap and used beverage cans (UBCs).

The result is a domestic scrap trade deficit of roughly 1.3 million tonnes each year, even though the US already runs a larger raw-aluminium gap of about 3.5-4.0 million tonnes annually.

Responses