As per the overview of the World Bank, Iraq remains on the list of countries that are heavily or mostly dependent on oil production and export. In the last few decades, its oil revenues have shouldered for more than 99% of exports, 85% of the government’s budget, and 42% of GDP. However, this uncurbed dependence on oil has forced the country towards macroeconomic volatility, while budget rigidities restrict fiscal space and any opportunity of countercyclical policy.

The economy is steadily recoiling from the double oil and COVID-19 impacts of 2020. In H1 2021 GDP grew by 0.9% Y-o-Y. The non-oil economy grew by over 21% in H1-21 (y/y), owing to a robust performance in the services sectors as COVID-19 containment measures were relaxed, supported by a drive in the vaccination campaign.

{alcircleadd}

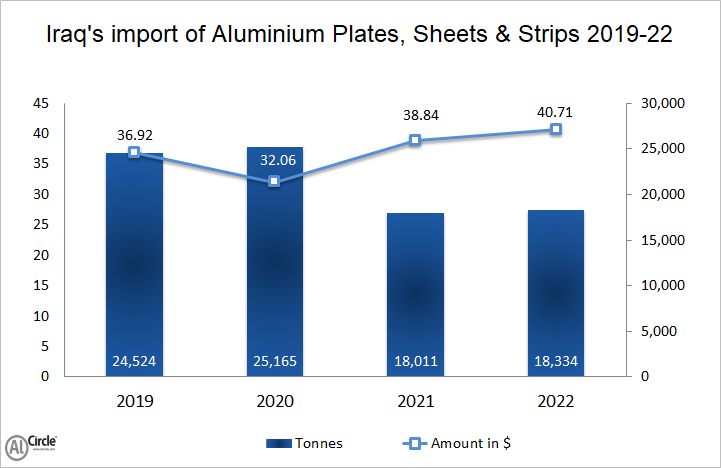

The war-torn nation in Western Asia bordered by the Persian Gulf, Iraq imported 67,700 tonnes of aluminium semi-finished goods (sheets, strips & plates), incurring a revenue outflow of around $107.82 million for the import.

In 2019, Iraq registered import of 24,524 tonnes of semi-finished goods, counting expenditure of $36.92 million, whereas, in 2020, the import manifested growth by 2.61%, as the import volume rose to 25,165 tonnes, while the expenditure dipped to $32.06 million. The nation is going through a lot of infrastructure developments, which requires a huge volume of semi-finished metal components and aluminium products requirements remains high.

The import for 2021 exhibited an edgy downfall of 28.42%, as the import volume plunged to 18,011, while the expenditure remained high at $38.84 million.

Iraq’s import of aluminium semi-finished goods for 2022 is estimated with a marginal gain of 1.79%, as the import volume might climb to 18,334 tonnes, staging the expenditure to touch $40.71 million.

The major trading destinations for Iraq’s import of aluminium semi-finished goods are China, France, Italy, South Korea, Turkey, etc.

Responses