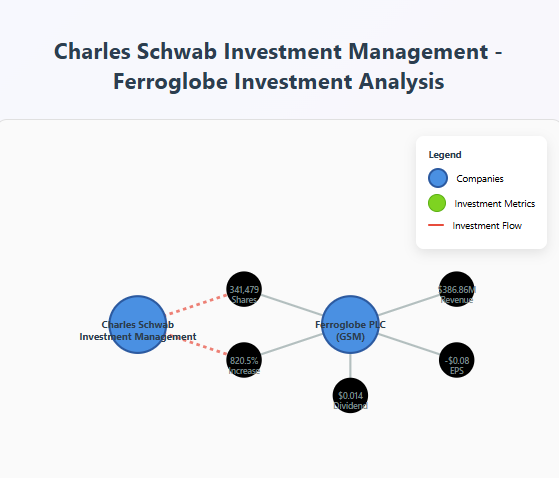

Charles Schwab Investment Management Inc. (CSIM), a registered investment advisory firm, lifted its position in Ferroglobe PLC, a London-based silicone supplier, by 820.5 per cent. This happened during the first quarter, according to its most recent SEC filing. The fund now owns 341,479 shares of the Ferroglobe PLC firm after acquiring 304,381 additional shares. It represents 0.18 per cent of the company and is worth USD 1.27 million.

The investment comes at a time of mixed fortunes for Ferroglobe. The firm reported a quarterly EPS of (0.08), missing the consensus estimate of (0.02), with revenues of USD 386.86 million. A dividend of USD 0.014 per share has been declared. It is payable on September 29, 2025, and offers a yield of 1.3 per cent.

A cyclical downturn

Although Ferroglobe has new institutional support, its Q1 2025 results also highlighted operational challenges. Revenue declined year-on-year by 32 per cent to USD 307.2 million. In contrast, its adjusted EBITDA fell to a loss of USD 26.8 million. Both numbers were impacted by a decline in shipping volumes and declining prices for silicon. Silicon metal revenue alone fell 35.2 per cent, representing a 27 per cent decline in shipments.

Management insists the downturn is cyclical and reaffirmed full-year guidance for a positive adjusted EBITDA of USD 100–170 million. Recent tariff actions could be important. The US has placed heavy duties on ferrosilicon imports, and the EU is contemplating the use of possible safeguards on silicon metal. If tariff actions remain in force, these developments could alleviate some surplus by curtailing production, which could eventually foster price stability in the second half of 2025.

Shares of Ferroglobe have struggled, declining from about USD 5.55 to USD 4.30 over the past year, equating to a 22.5 per cent total shareholder return. In comparison, the S&P 500 gained 13.4 per cent over the same period. Analysts remain cautious, as Wall Street Zen recently downgraded its stock from “hold” to “sell”.

Still, with institutional investors owning nearly 90 per cent of the float and Charles Schwab significantly raising exposure, there is confidence in long-term fundamentals. Ferroglobe’s strategy hinges on technology upgrades, disciplined cost control, and the macro backdrop of tariffs and demand recovery in aluminium and steel markets.

Responses