您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

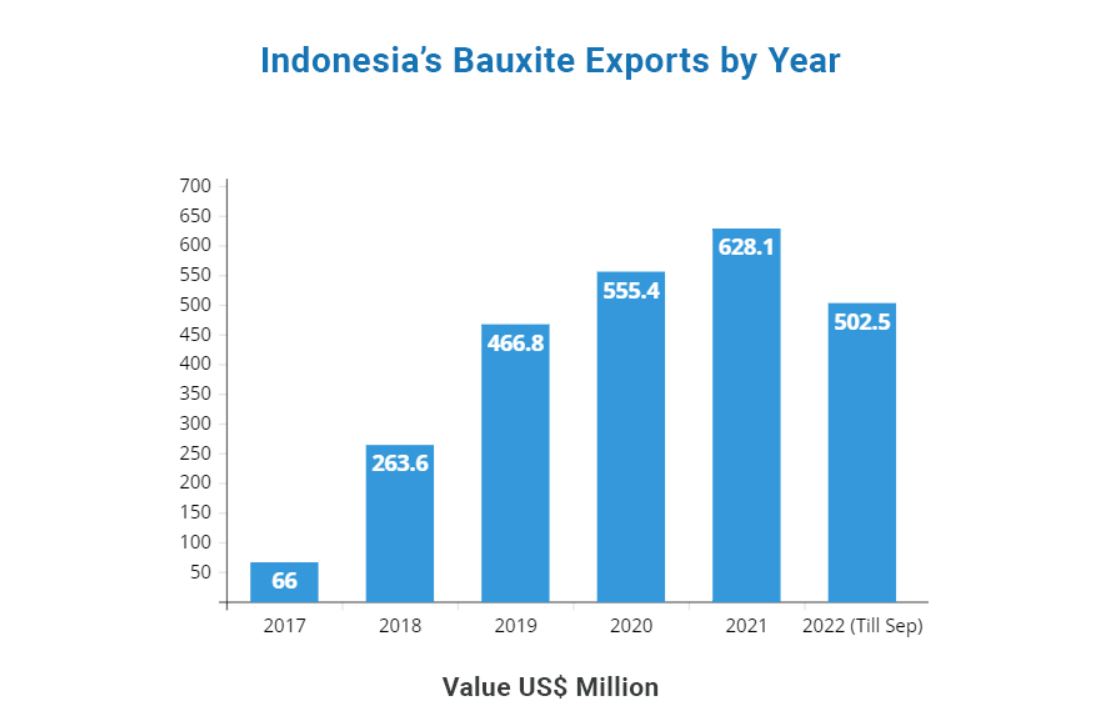

Indonesia is rich in bauxite. That is no news. It has been exporting bauxite to leading aluminium-producing countries for years. That is no news either. It imposed a ban on its bauxite export back in 2023. While that creates a whirl for a while, the world has re-strategised and found its bauxite (whether the deficit has been completely replenished or not, we will come to that later)! But a product export that once generated over USD 600 million for Indonesia is now running at nil. Au contraire, the nation’s alumina import (a product derived from bauxite and is further refined to produce aluminium) has peaked in the past two years (2023-2024).

Image source: https://www.exportgenius.in/

Explore- Most accurate data to drive business decisions with 50+ reports across the value chain

In contrast, alumina, the intermediate product refined from bauxite and required for smelting aluminium, has moved in the opposite direction. Indonesia’s alumina imports surged through 2023 and 2024, signalling a widening gap between domestic bauxite supply and domestic processing capability.

In the same year as the bauxite ban, the government also placed aluminium on its newly released list of critical minerals. Aluminium met every criterion set by policymakers: strategic industrial importance, economic significance, supply vulnerability and limited substitution. This classification effectively raised aluminium from a common industrial metal to a strategic resource aligned with national industrialisation plans.

This naturally raises the question: is Indonesia positioning itself to dominate the entire aluminium value chain — from ore to downstream semi-finished products — especially as low-carbon technologies reshape global manufacturing priorities?

According to data from the Ministry of Industry (Kemenperin), alumina imports were 711,000 tonnes in 2023. They climbed sharply in 2024 before easing this year.

“Alumina imports in 2024 were around 1.07 million tonnes, and they decreased in 2025, but as of August, the data still stood at 819,000 tonnes,” said Yosef Danianta Kurniawan, Head of the Non-Ferrous Metals Industry Working Team, during a Forwin media briefing in Sentul, Bogor, on November 14.

…and so much more!

SIGN UP / LOGINResponses