您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

India is set to retain its position as the world’s second-largest primary aluminium producer, with a record-breaking monthly output in the opening month (April) of FY2025-26. Provisional figures indicate strong year-on-year growth in both primary aluminium and its core raw material (bauxite). While bauxite output soared with a double-digit jump, aluminium production posted a modest rise, underscoring an overall impressive growth trajectory in India’s metal and mining industry.

Raw material first

In April 2025, production of bauxite rose 13.9 per cent year-on-year from 1.87 million tonnes to 2.13 million tonnes. During FY2024-25, the country produced 24.7 million tonnes of bauxite, securing its place as the world’s fifth-largest producer after Guinea, Australia, China, and Brazil. Year-on-year, the shift in production marked a 2.9 per cent increase from the 24 million tonnes recorded in FY2023-24.

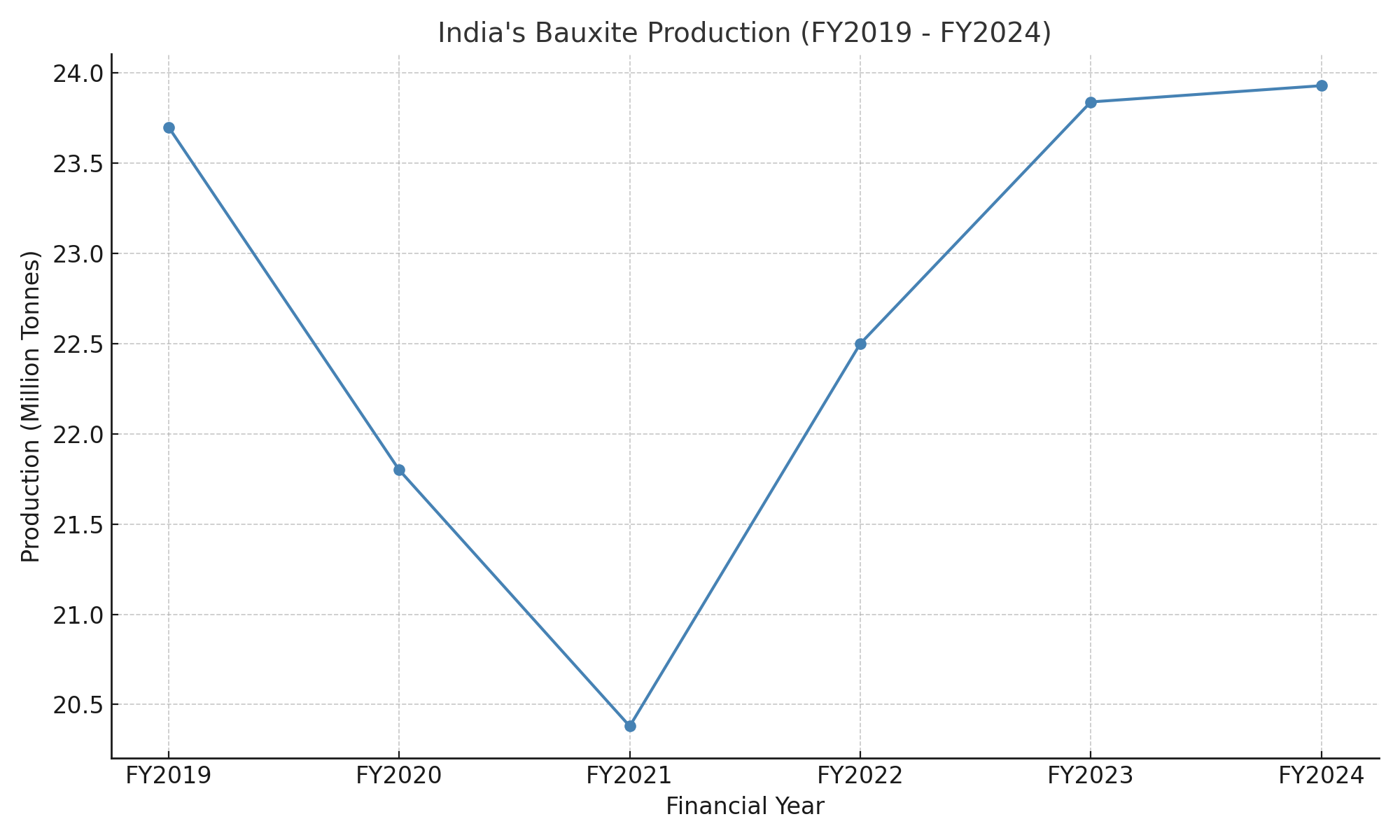

Historical data since FY2019-20 shows that India’s bauxite production rebounded strongly after two consecutive years of decline, bottoming out at 2.04 million tonnes in FY2021. Output began to recover in FY2022, reaching 22.5 million tonnes, and continued its upward trajectory to 23.84 million tonnes in FY2023.

Also read: Rise in India’s aluminium production, a ripple effect of wider mineral market uptick

Rising output amid growing imports

India could retain its robust bauxite production even amid the constant rise in imports of the ore. According to the Ministry of Mines, India’s bauxite imports at the end of FY2024 were 4.5 million tonnes of bauxite, up from 3.6 million tonnes in FY2023, and in the earlier year, the import volume was 3 million tonnes.

What does that mean?

Despite the growth in India’s domestic bauxite production, why is import volume increasing? There could several factors behind this scenario – inefficient auction and bauxite mines development could be one among many others like rapidly growing domestic aluminum industry and regulatory hurdles.

In 2021, the auction of Karlapat bauxite mine was put on hold, followed by an abrupt end of public hearing of Vedanta’s proposed bauxite mining in Sijimali area of Odisha’s Koraput district.

Adequate supply is non-negotiable

No matter what, the abundant supply chain of bauxite is much required in India owing to the rise in primary aluminium production and its demand. In April 2025, India’s primary aluminium production gained 1.5 per cent Y-o-Y, from 3.42 lakh tonnes to 3.47 lakh tonnes. At the end of FY2025, India’s primary aluminium output touched the 4.2 million tonnes mark compared to 4.16 million tonnes in the previous year.

Also read: World primary aluminium production declines 3% in April 2025, extending three-year trend

Responses