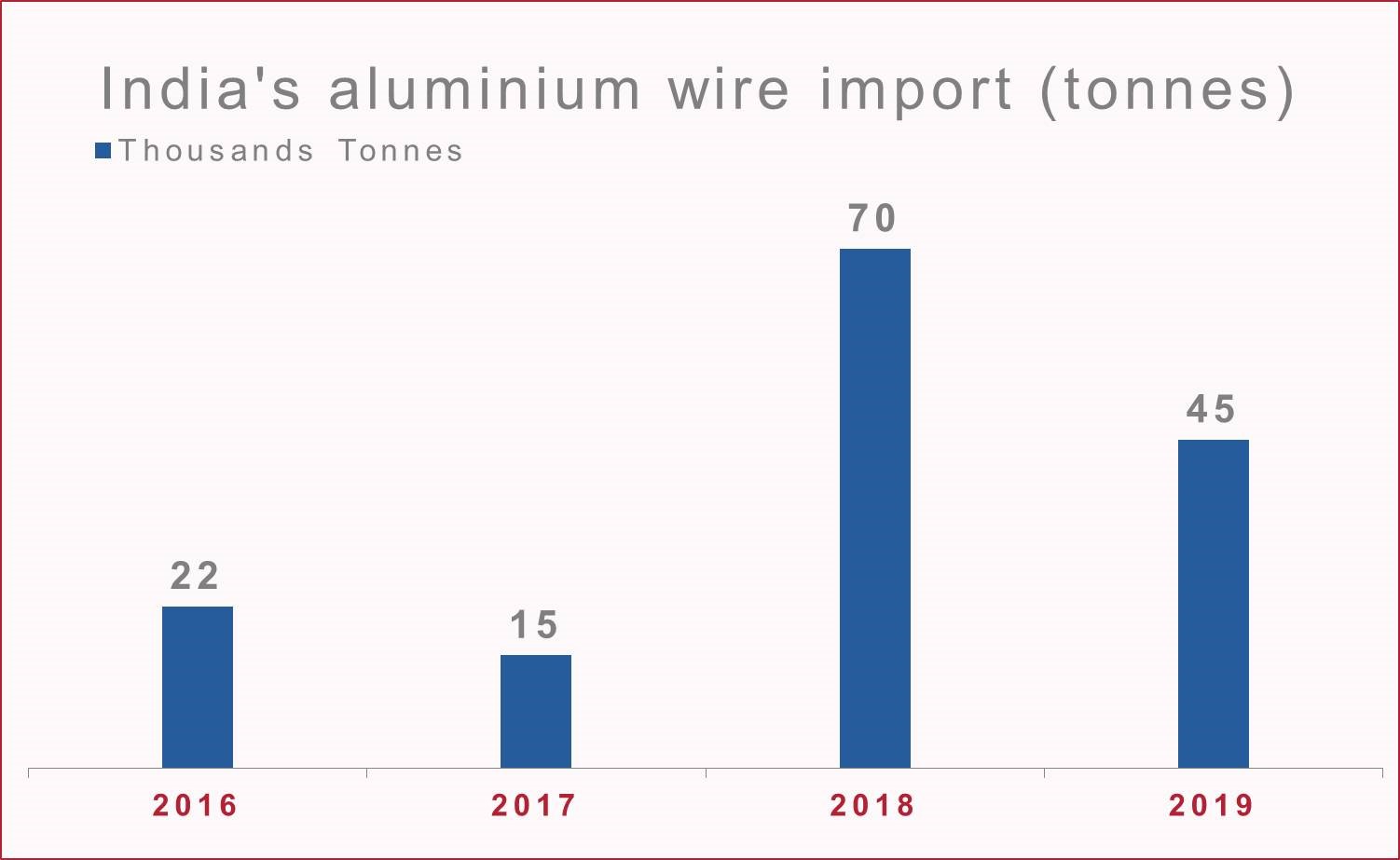

Wires form a large portion of the total aluminium product import by India as 48% of aluminium consumption in the country is in the electrical sector. In 2018, India had seen a sharp growth in aluminium wire import straight from 15,315 tonnes in 2017 to 70,396 tonnes, up 360 per cent according to global export-import data. Increasing demand towards diverse, innovative product grades for electrical and automotive applications particularly led to this notable growth in India’s 2018 aluminium wire import.

{newsStudioGallery}

{alcircleadd}But in 2017, India’s aluminium wire import volume stood down by 30 per cent year-on-year, as the country’s import amount in 2016 was at 21,953 tonnes. Even this year, India’s aluminium wire import is likely to be lower than the previous year at 44,529 tonnes, down 37 per cent according to the available data.

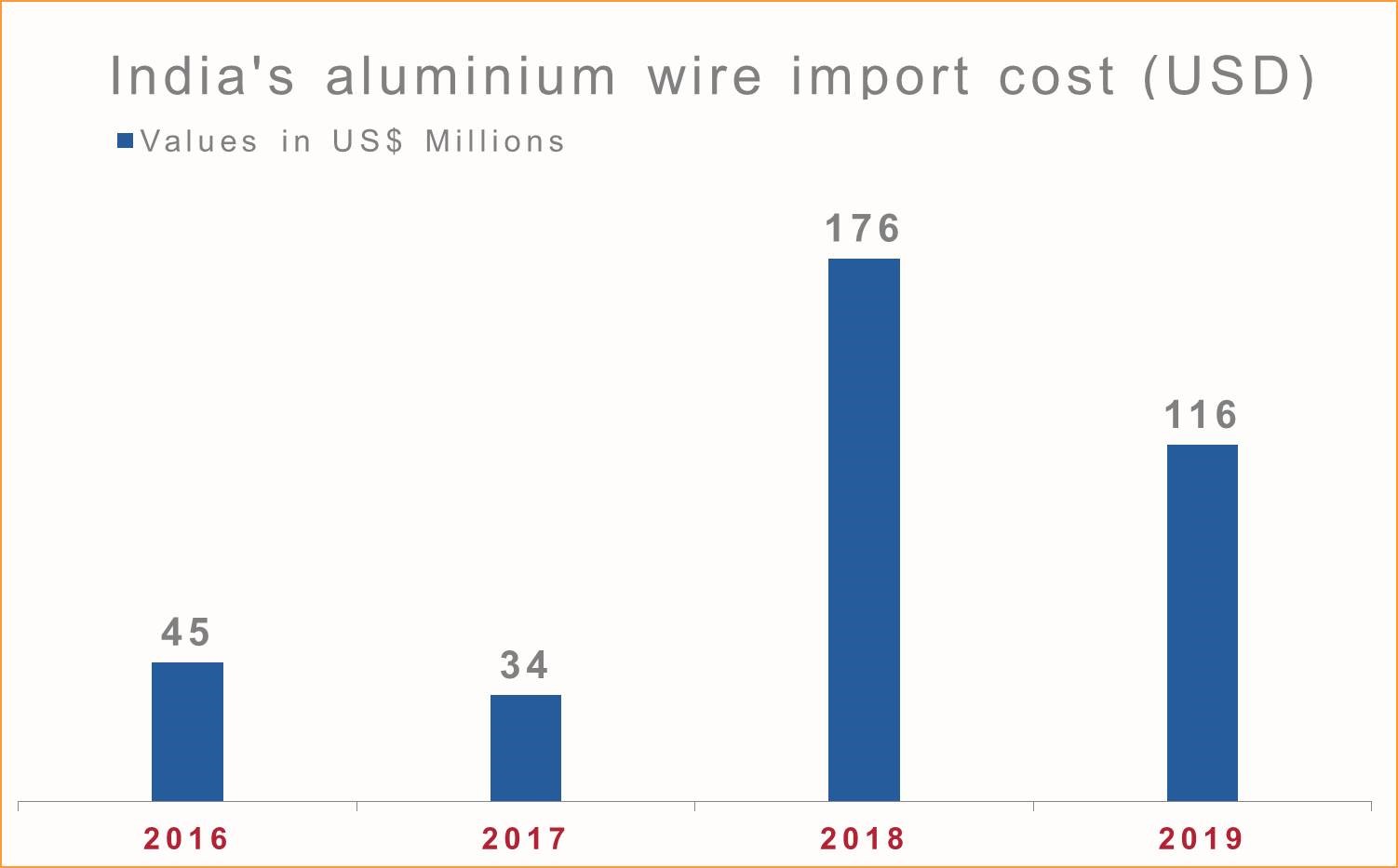

In tandem with the import volume, India’s aluminium wire import cost also remained fluctuating from 2016 to 2018. After a decline from US$45 million in 2016 to US$34 million in 2017, the country’s wire import cost jumped to US$176 million in 2018, up 417 per cent year-on-year. The year 2019 is again likely to see a dip in India’s import cost totalling at US$116 million, down 34 per cent YoY.

India’s largest amount of aluminium wire import is estimated to come from Malaysia this year – 31,556 tonnes at the value of US$82 million. Bahrain is estimated to be the second highest supplier 4302 tonnes at US$10 million, followed by Oman 4190 tonnes also at US$10 million, and the United Arab Emirates 1969 tonnes at US$4 million.

Global aluminum wire market revenue is slated to exceed US$ 65 billion by 2024. Superior properties which include light weight, high strength and corrosion resistance may cater to construction and electrical industries, thus propelling industry growth over the forecast timeframe.

Responses