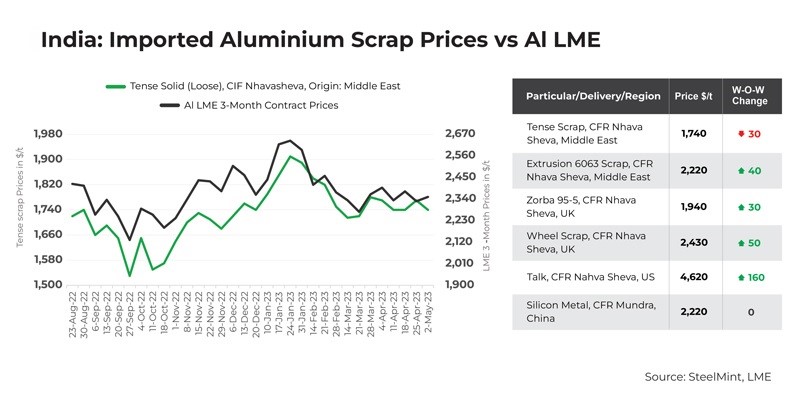

Following growth in major commodity markets like the London Metal Exchange (LME) and the Multi Commodities Exchange (MCX), the price of imported aluminium scrap in India witnessed significant progress this week. Despite higher prices, buyers are sourcing imported material from overseas markets like the Middle East and Western nations.

Higher offers are due to tight supplies in the European market. Market players, most purchasers, said that the domestic supply of select grades, such as tense, is limited, and sellers offer higher prices. On the LME, three-month aluminium futures and spot prices fell by $26 per tonne y-o-y to $2,355 per tonne from $2,381 per tonne on April 25. Aluminium inventories were expected to be 568,500 tonnes, a decrease from 569,600 tonnes the previous week.

In the face of uncertainty surrounding a potential interest rate hike by the US and Australia, scrap buyers and importers have been cautious about inventory levels and are trying to maintain a healthy pipeline of raw materials. The UK's house price index has declined, and retail sales have slowed in one of Europe's largest markets due to a decline in house prices.

Indian market members are generally optimistic about the country's aluminium consumption, with demand from the infrastructure sector expanding gradually. A few scrap importers predict that prices will continue to fall, although at a slower rate. Small-scale alloy ingot makers may have difficulties in obtaining future reservations.

Received under the content exchange agreement with SteelMint

Responses