Independent Bermuda-based bulk carrier firm Himalaya Shipping Ltd. (“Himalaya,” “Himalaya Shipping,” or the “Company”) has released strong preliminary unaudited results for the three and six months ended June 30, 2025, all while operating in a freight market that continues to experience the fallout from global tensions in metals trading.

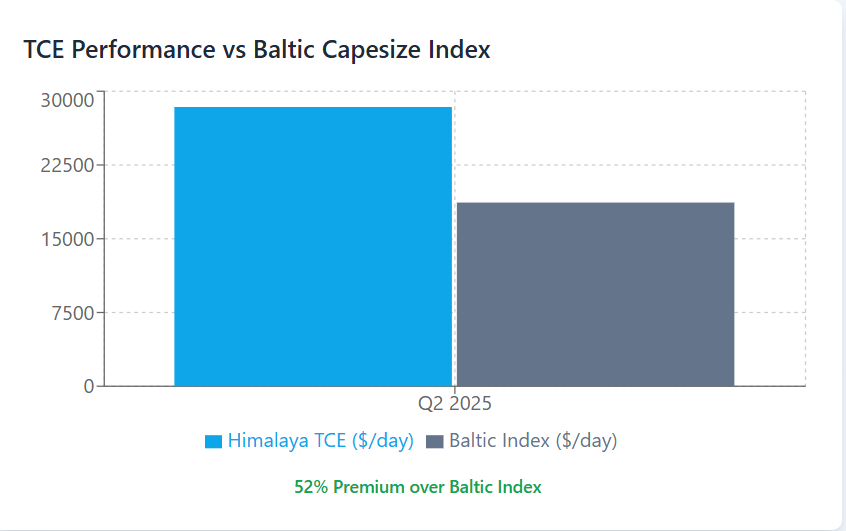

In Q2, the company had a net income of USD 1.1 million and EBITDA of USD 20.9 million and average daily time charter equivalent (TCE) earnings (gross) of about USD 28,400 per day, which was well above the Baltic Capesize Index (BCI) average of USD 18,681 per day for the quarter. Distributions were paid in cash of USD 0.025, USD 0.03, and USD 0.05 per share in April, May, and June, respectively.

The quarter also saw a leadership transition, with Lars-Christian Svensen contracted as CEO and Vidar Hasund as CFO, effective April 1, accompanied by a grant of options to purchase 200,000 shares to key staff members. Himalaya successfully uplisted from Euronext Expand to Euronext Oslo Børs on June 3rd.

Also read: Advanced Industrial Technologies in the ALuminium Industry (Part II)

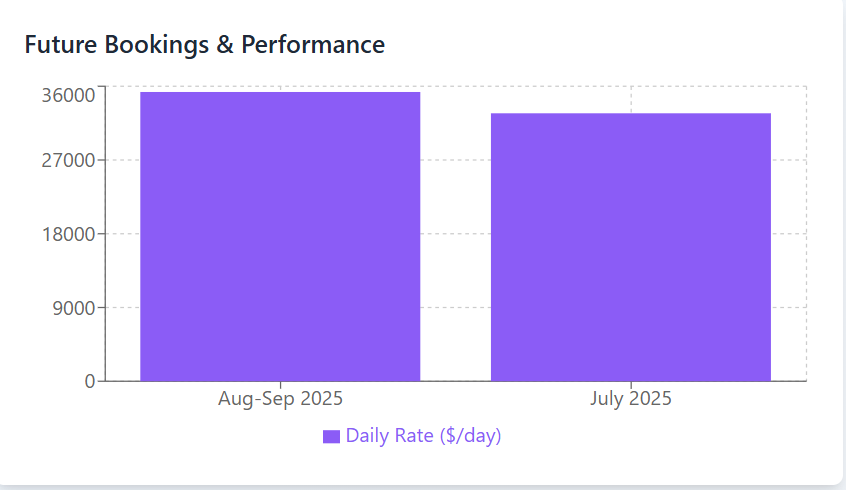

Following quarter-end, the company fixed four vessels at an average rate of approximately USD 35,300 per day, gross, from August 1 to September 30, 2025, and achieved July TCE earnings of USD 32,700 per day.

Himalaya CEO highlights fleet gains, bauxite growth opportunities

CEO Lars-Christian Svensen said, “During the second quarter of 2025, the Baltic Capesize Index averaged USD 18,681 per day, while the Himalaya fleet achieved average TCE earnings of around USD 28,400 per day over the same period. This performance underscores the strong capabilities and potential of our vessels, as well as the solid commercial execution to date. Of our 12 vessels, 10 were active in the spot market, earning an average premium of 42.2 per cent over the Baltic 5TC (BCI) index (excluding scrubber benefits).”

He commented that international bauxite volumes were up 27 per cent year-on-year in the first half of 2025, helping to offset weaker tonnes of iron ore and coal, and with the upcoming Simandou iron ore project in Guinea representing a long-term tonne-mile growth opportunity.

Tariffs cast a global backdrop

Himalaya's solid performance is taking place amidst a backdrop of policy challenges in the metals market. In June, President Trump imposed a tariff on global aluminium and steel imports, doubling it to 50 per cent due to national security concerns about domestic production levels.

While the tariffs are not directly impacting the Capesize or Newcastlemax segments, and less than 2 per cent of all large-size dry bulk trades are impacted, these tariffs have produced uncertainty for sectors dependent on both metals. The US and Canada are still negotiating ahead of the August 1 deadline, and US Treasury Secretary Scott Bessent suggested relief may be coming for Canadian producers.

Himalaya remains committed to monthly shareholder distributions, with Svensen hinting that if market momentum holds, “there may be a potential to increase distributions.”

Also read: Aluminium Flat Rolled Products: Insights & Forecast to 2030

Responses