Indian aluminium extrusion manufacturers are sounding the alarm over surging pressure from low-priced Chinese imports. They warn that these imports, facilitated indirectly through regional trade agreements, are disrupting domestic competitiveness, exposing a critical imbalance in the market's playing field. This led to the manufacturers demanding that the government re-examine the Free Trade Agreement (FTA) between ASEAN countries and the United Arab Emirates (UAE).

Industry stakeholders allege that China is routing its finished aluminium products into the Indian market via Vietnam and Malaysia at zero duty under the FTA framework. In contrast, domestic producers face an 8.25 per cent import duty burden, leaving them at a competitive disadvantage against Chinese suppliers in both domestic and global markets.

Industry representatives thus emphasise the need for stronger safeguards within FTAs with Far East nations and other countries to protect and revive domestic manufacturing units.

Owing to this, Ankur Aggarwal, general secretary, Aluminium Extrusion Manufacturers Association of India (ALEMAI) stated, "Indian manufacturers are paying 7.5 per cent duty on raw materials and 10 per cent surcharge totalling 8.25 per cent as against the duty exemption offered by the government in China. This makes our products expensive when compared to Chinese finished goods, thereby causing a loss of market for Indian producers. We have urged the government to re-look at the FTA with ASEAN and UAE so that China stops dumping its products in the Indian market."

Free Trade Agreement between ASEAN countries and the UAE

ASEAN–India Free Trade Area (AIFTA)

Launched on January 1 2010, AIFTA integrates a massive market of nearly 1.9 billion people with a combined GDP of approximately USD 4.8 trillion. The agreement phased out tariffs on over 90 per cent of products, including key items like palm oil, black tea, coffee and pepper and planned tariff elimination on more than 4,000 product categories.

ASEAN–China Free Trade Area (ACFTA)

Established in 2004 and implemented in July 2005, ACFTA has successfully eliminated tariffs on roughly 90 per cent of traded goods over 7,000 product lines across member states, initially for ASEAN-6 and fully extended to all by 2015. A 2019 upgrade further streamlined Rules of Origin, customs processes and investment procedures to enhance trade facilitation.

UAE–India Comprehensive Economic Partnership Agreement (CEPA)

Established on May 1, 2022, the CEPA pact reduces tariffs on over 80% of products, ensures a non-discriminatory cross-border trade environment, and strengthens market access through tariff preferences and procurement benefits. It further opens opportunities for UAE service providers across 11 sectors and 100+ sub-sectors, aligns technical standards internationally, safeguards against anti-dumping actions from transhipment, and is governed by a Joint Committee tasked with reviewing and expanding market access over time.

Also read: India dethrones China in US smartphone exports, but the real story is aluminium

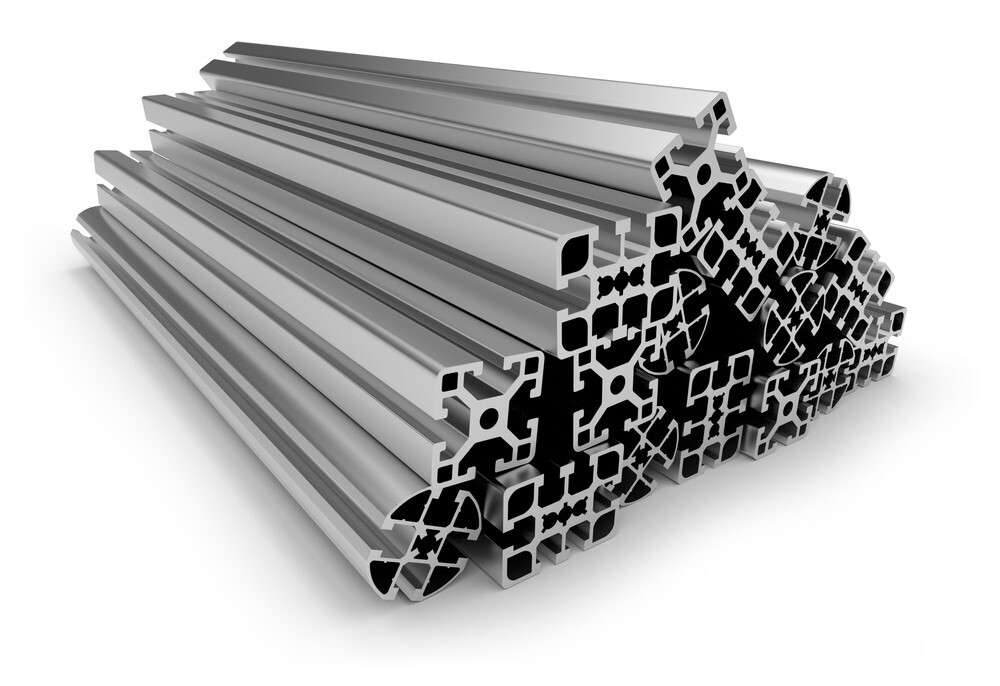

India's aluminium extrusion market

India's aluminium extrusion market was valued at USD 3.51 billion in 2024 and is projected to reach USD 4.61 billion by 2030, reflecting a CAGR of 4.5 per cent. While North India continues to lead the market, South India is driven by Karnataka and is emerging as a significant growth hub.

Sectors driving the demand for aluminium extrusion in India

As per the AL Circle research estimates, sectors like transport, industrial and electronics sector is expected to increase the use of aluminium extrusion in comparison to others. Moreover, the Indian extrusion industry is moving at an exceptional pace in terms of installing large presses. India consumed an estimated 250,000 tonnes of aluminium extrusions in construction applications, with architectural uses, such as doors, windows, curtain walls, and glazing, accounting for nearly 40 per cent of total demand in the building and construction sector.

Moreover, in 2023, aluminium consumption in India's building and construction sector was estimated at 280,000 to 300,000 tonnes, with demand driven mainly by sections for doors and windows. The industry is expected to expand at a robust 8 to 10 per cent annually over the next five years, supported by strong investment momentum, government policy initiatives and rising consumption.

On the other hand, the demand for aluminium extrusions in India's electrical & electronics (E&E) and industrial sectors is set to rise, fueled by increasing investments in solar energy and capacity expansions across key industries to match the country's accelerating economic growth.

Indian aluminium extrusion market

India's construction sector is witnessing strong momentum, driven by surging urban housing demand and rising government investments in infrastructure such as roads, ports and airports. According to industry estimates, the aluminium extrusion sector could generate up to 30 million new jobs by 2030, adding to the existing 70 million workforce, with total employment reaching 100 million.

Real estate turnover is projected to grow from USD 650 billion to USD 1 trillion by 2030, with construction and real estate expected to contribute nearly 20 per cent of India's economy. Backed by a projected 6.7 per cent annual GDP growth through 2031, this expansion offers significant opportunities for industries like aluminium, which play a critical role in construction and urban development.

ALEMAI President Jitendra Chopra stated, "The biggest challenge is the under-utilisation of domestic manufacturing capacity due to cheap imports. The total installed aluminium extrusion capacity in India is 3.5 million tonnes per annum, but the utilisation is only around 2 million tonnes, with the remaining 1.5 million tonnes imported. There is a need to put in place safeguards in FTAs with Far East countries and other nations to revive domestic units."

He further also said that the industry stakeholders should remain cautious over global challenges, citing raw material price volatility, elevated energy costs and the recent 50 per cent tariff imposed by the US on aluminium products from India, which could weigh on export competitiveness.

The rising influx of low-priced imports, coupled with trade imbalances under existing FTAs, underpins the urgent need for policy recalibration to safeguard domestic aluminium extrusion players. With India's construction, infrastructure and industrial sectors poised for robust growth, creating a level playing field will be critical to ensuring that domestic manufacturers can capitalise on emerging opportunities and strengthen their role in the global value chain.

Responses