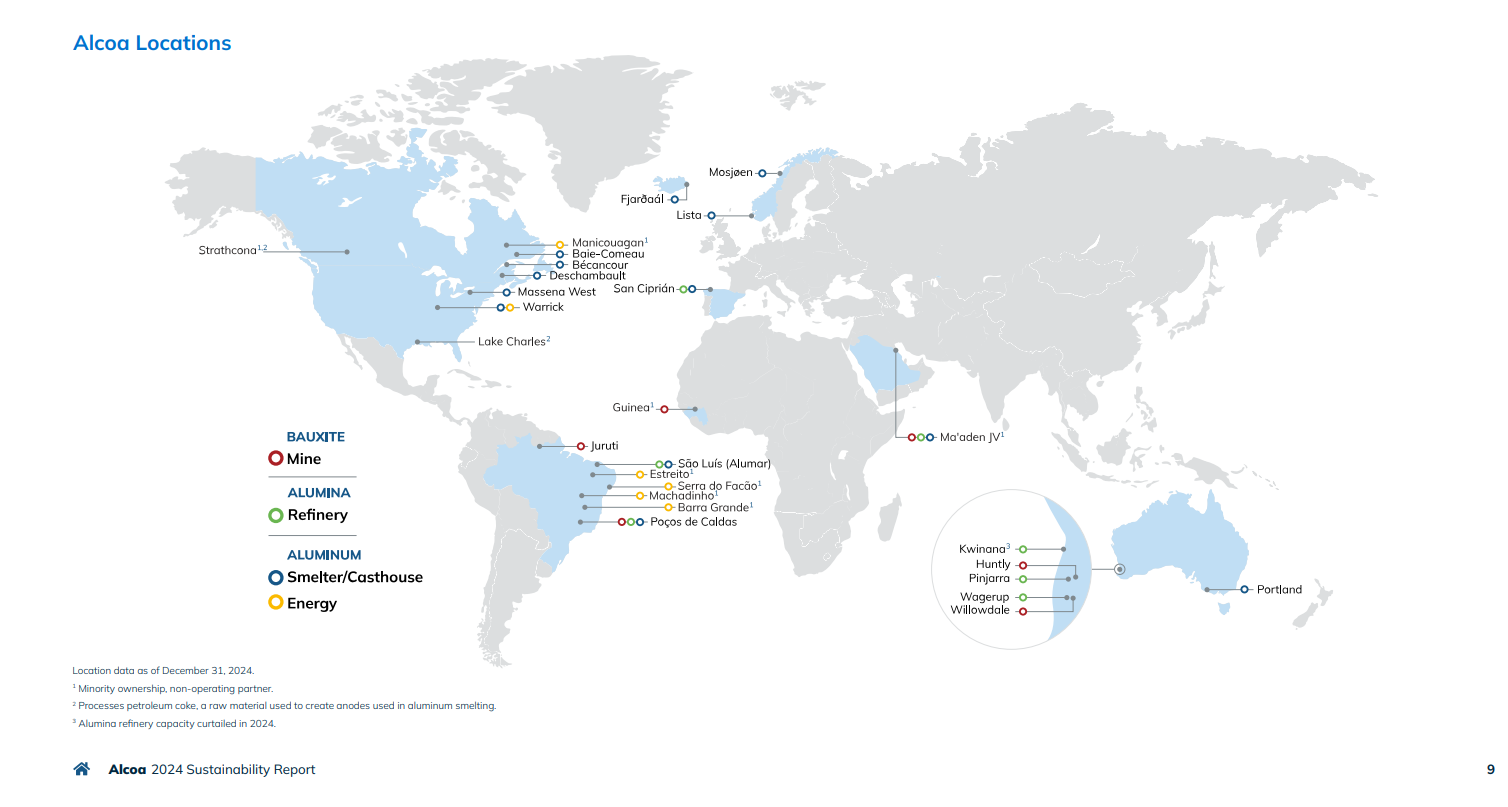

In a metal market battered by volatile prices, inflationary stress, and escalating scrutiny over climate credentials, Alcoa’s 2024 Sustainability Report arrives not just as a routine corporate checklist but as a statement of ambition — and, in some areas, quiet disruption. With operations sprawling across 30 global facilities — from bauxite mines to smelters and casthouses — the US-based aluminium major shoulders more than just metal output; it shoulders a reputation. But does Alcoa’s latest ESG report genuinely reflect industry leadership, or is it a slick exercise in eco-branding? Let’s unpack the facts, compare performance, and critically assess how the numbers stack up.

Renewable power — a benchmark or a baseline?

In 2024, 86 per cent of the electricity powering Alcoa’s smelters came from renewable sources. On the surface, this reinforces Alcoa’s edge in a sector where grid dependency remains overwhelmingly carbon-intensive. For perspective, industry peers like Rusal — the world’s largest producer of low-carbon aluminium — powered about 90 per cent of its production with hydroelectricity. Meanwhile, despite being the world’s largest aluminium producer, China Hongqiao still relies heavily on captive coal-fired plants, though it is slowly migrating to Yunnan’s hydropower network.

While Alcoa’s renewable share remains commendable, especially in the US context where smelters like Warrick are tied to green energy, the figure has plateaued since 2022, when the company already claimed over 85 per cent renewables. This begs the question: has Alcoa hit a saturation point, or is more structural innovation needed?

Land stewardship: a quiet revolution in mining

Events

Events

e-Magazines

e-Magazines

Reports

Reports

Responses