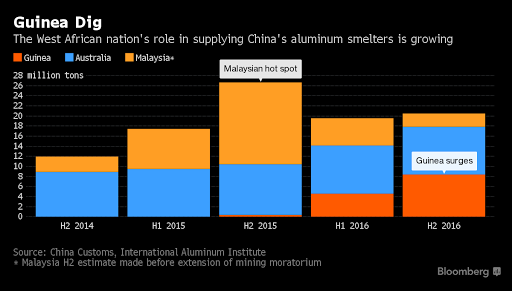

Since the time Indonesia had imposed a ban on ore export two years back creating a sudden lull in the hyperactive export market for China, a number of countries came up to seize the market and provide an alternative source of bauxite for China. Australia took the first plunge and continued to export a large amount of bauxite to China. It was followed by Malaysia and the country continued to export to China till the Malaysian government imposed almost a yearly ban on the mining and export of bauxite effective January 2016 amid worries over its severe environmental impact. This again put Australia back into the export market to China.

China’s hunger for bauxite will not cease to increase in near term as the country keeps on adding its aluminium capacity. Now, the reports indicate that Guinea will take over Australia’s position to become China’s main source of bauxite in 2017. China is looking at the West African nation as the safest supplier of bauxite for future after juggling through a number of sources in last two years to sustain their growing aluminium industry.

As reported by Ron Knapp, secretary general of the International Aluminium Institute, Guinean bauxite shipment to China will reach about 13 million metric tons by the end of this year, rising from just 300,000 tons in 2015. This would put Guinea in the second position surpassing Malaysia as a bauxite supplier to China. At an industry conference in Shanghai, Mr. Knapp indicated that the export will increase in 2017 to beat Australia. However, he didn’t give specific volume forecasts for 2017.

{googleAdsense}

“Guinea has a medium- and long-term role in world bauxite supplies,” Knapp said during a presentation at the conference. The world will need between 45-and-50 million tons of extra annual bauxite supply by 2020…the arrival of Guinea bauxite in the Asian region will help determine market boundaries for other entrants,” he said.

China produced 55 per cent of world aluminium output in 2015, up from 25 per cent a decade earlier and the rapid growth has boosted demand for bauxite. China imported 56 million tons of bauxite in 2015, which was 30 million tons in 2010. According to the United States Geological Survey, Guinea has about a quarter of the world’s known reserves.

Yin Zhonglin, senior engineer at Aluminum Corp. of China Ltd., said at the conference. “Guinea and Brazil with stable grades have emerged as major suppliers along with Australia.”

In the meantime International Aluminium Institute reported that Australian shipments of bauxite to China are 19 million tons which is a drop from 19.6 million tons in 2015. Malaysia’s shipments will drop below 8 million tons from 24 million tons in 2015 after the mining and export ban. Malaysia was only a “short-term hot spot” for the Chinese industry last year as it has limited bauxite resources, Knapp said.

China’s biggest metal producer Hongqiao group runs bauxite operations in Guinea and ships the raw material to its own refineries in China’s coastal Shandong province. According to Abdoulaye Magassouba, the mining minister of Guinea, Bauxite mining is a significant source for the economic growth of the country and the investment in this sector will exceed $2 billion in a few years. This will raise the country’s stature in the global market.

{alcircleadd}

Responses