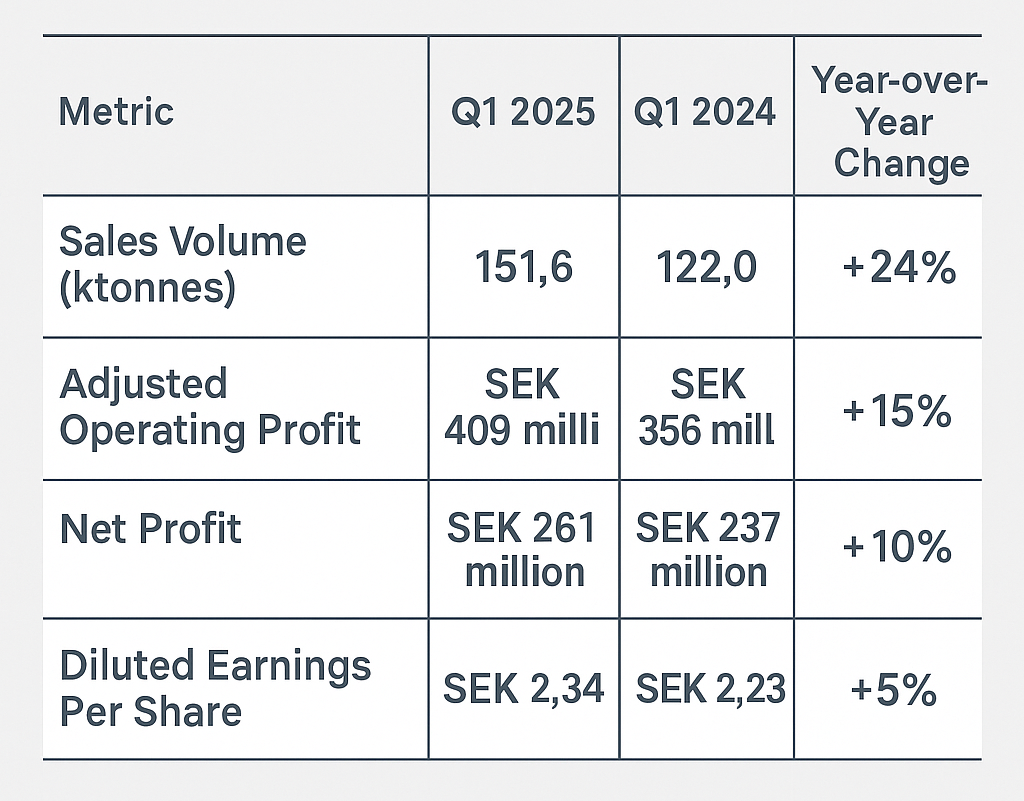

In the first quarter of 2025, Gränges AB demonstrated resilience and foresight despite coming across multiple obstacles, achieving record-breaking results despite facing a complex global market landscape. Gränges reported a significant 24 per cent increase in sales volume, reaching 151.6 thousand tonnes, up from 122 thousand tonnes in the same period the previous year. This surge was accompanied by a 15 per cent rise in adjusted operating profit, totalling SEK 409 million, marking the company’s strongest first-quarter performance to date. The profit for the period climbed to SEK 261 million, with diluted earnings per share increasing to SEK 2.34.

Image for representational purposes only (source: https://www.granges.com/)

Image for representational purposes only (source: https://www.granges.com/)

Gränges’ CEO, Jörgen Rosengren, attributed the company’s strong performance to increased market share, operational excellence, and successful expansion in Asia. “In the first quarter, Gränges delivered strong volume and profit growth in challenging external conditions,” says Gränges’ CEO Jörgen Rosengren. “Market demand was good in HVAC and stable in speciality packaging and other niches, while conditions in automotive remained soft. Thanks to increased market share, good operational performance and the newly gained business in Asia, we grew sales volume by 24 per cent year-on-year.”

Financial Highlights

Regional Performance

The Americas segment experienced an 8 per cent increase in sales volume, driven by strong demand and continued market share gains. Profitability improved due to higher sales volumes, increased productivity, and an enhanced product mix.

Asia stood out with an impressive 81 per cent surge in sales volume, primarily attributed to newly acquired business and ongoing market share expansion in applications such as automotive heat exchangers, battery casings, and cooling plates. The integration of the new Shandong plant progressed smoothly, facilitating entry into additional market niches. Despite price pressures, higher sales volumes and productivity gains offset the challenges.

In Europe, sales volume grew by 4 per cent, even amid a soft market environment. This growth was supported by new business wins in materials for electric vehicles and other specialised applications. Continued productivity improvements helped mitigate pricing pressures.

Sustainability Metrics

“We’re now entering the second phase: building a leader. Our global team is focused on increasing utilisation, optimising price and mix and further improving productivity,” Rosengren says. Noting that the company’s 800,000 tonnes of capacity allow for growth, “we can execute this plan without major expansion projects and therefore with lower capital expenditure and better cash flow than previously,” Rosengren says. “The plan centres on ensuring safety, engaging our people and continuing our important sustainability journey to net-zero by 2040 with our customers and partners.”

The company’s three operating segments — Gränges Americas, Gränges Asia, and Gränges Europe — each contributed to the overall growth and improved earnings. With the successful integration of the Shandong plant and continued focus on efficiency and market expansion, Gränges is well-positioned to sustain its growth trajectory in the coming quarters.

Responses