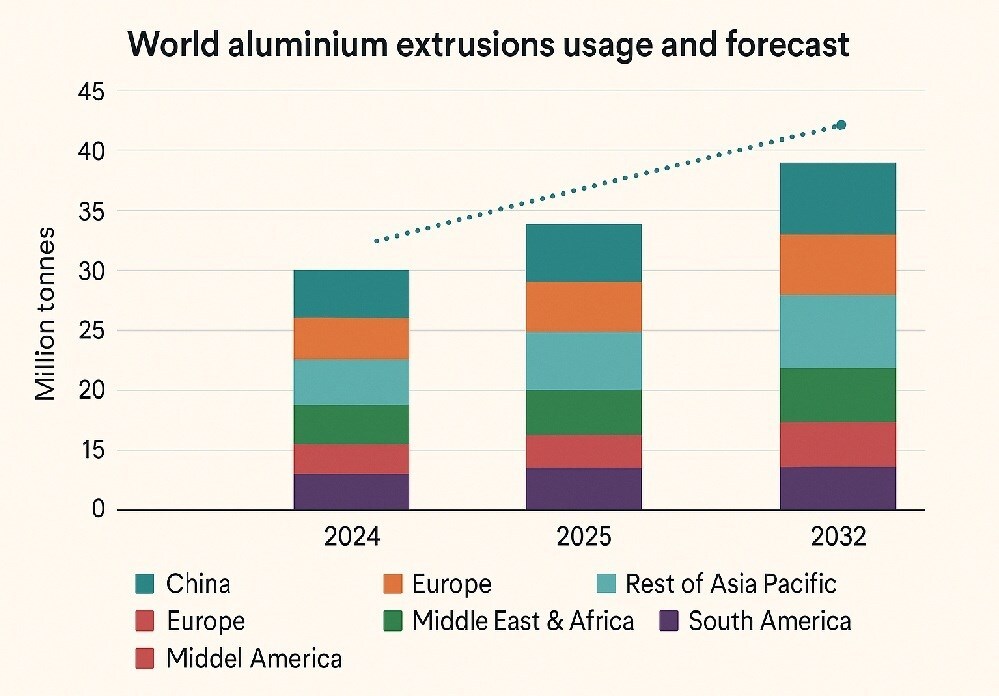

As 2025 draws to a close, the aluminium extrusion industry finds itself steadier than it started, as global usage is expected to settle at 35.25 million tonnes, just above 34.27 million tonnes in 2024, a modest 2.8 per cent increase that reflects stability in a market still navigating post-pandemic aftershocks. The pressures haven’t eased: geopolitical tensions continue to shift unpredictably, construction activity remains slower than before 2020, major economies struggle to regain momentum, and energy costs stay elevated.

Yet the longer arc remains upward. Forecasts suggest the sector could reach 43.58 million tonnes by 2032, supported by a 3.05 per cent CAGR. By the end of 2025, the defining theme is clear—not a dramatic rebound, but a steady, resilient climb. To access the data, download: The World of Aluminium Extrusions – Industry Forecast to 2032.

If 2024 proved anything, it’s that China’s grip on the aluminium extrusion market is as firm as ever. The country accounted for around 65 per cent of global usage that year — an extraordinary share by any measure. Europe follows next, then the Rest of Asia Pacific, and after that North America with just 8 per cent, and the Middle East & Africa with 4 per cent.

China continues to pull further ahead in 2025, lifting its aluminium extrusion consumption from 22.32 million tonnes in 2024 to roughly 22.87 million tonnes, and the outlook suggests it will keep expanding at about 3.16 per cent a year through 2032. The Rest of Asia Pacific is on an upward track as well, moving from 3.16 million tonnes to 3.31 million tonnes, supported by a stronger 3.62 per cent CAGR.

Responses