Global aluminium usage is stabilising after a choppy period and is positioned for steady expansion this decade, supported by electric mobility, packaging, and a gradual rebound in construction.

Source: AI-driven image

Source: AI-driven image

According to industry estimates, Asia Pacific (including China) is set to account for 66 per cent of global aluminium usage in 2024, with North America at 13 per cent and Europe at 12 per cent.

Aluminium Foil and its End Uses Current Trends and Forecast till 2030

The market is projected to grow from 101.3 million tonnes in 2024 to 122 million tonnes by 2030, a 3.15 per cent CAGR, with 2025 consumption expected at 104.7 million tonnes.

This trajectory—tempered but durable—reflects outcomes from business market analysis and industry trend analysis that highlight resilient downstream demand and a shifting competitive landscape analysis across regions.

Sector mix: Transport and construction remain first among equals

The transportation and building & construction segments together account for 49 per cent of global aluminium usage. The transport sector continues to increase aluminium intensity, particularly in battery electric vehicles (BEVs), where lightweighting remains a primary lever for range and efficiency. On the built-environment side, aluminium usage is set to track a 3.1 per cent growth in the global construction market as expected interest-rate cuts filter through project pipelines—though this follows several challenging years.

Aluminium Foil and its End Uses Current Trends and Forecast till 2030

Packaging—notably beverage cans—remains a bright spot, with the global can market forecast to expand 4.2 per cent on sustainability attributes and robust end-customer acceptance. Foil stock demand is expected to rise 3.0–3.6 per cent, underpinned by the accelerating buildout of lithium-ion battery capacity and a rebound in BEV production after a tough 2023. Together with electrical & electronics and industrial applications, these sectors provide diversified ballast to demand.

Looking for actionable insights into one of the fastest-growing segments in the global metals industry? The updated "World Recycled Aluminium Market Analysis – Industry Forecast to 2032" delivers exclusive data on market trends, regional demand, trade, policy shifts, technology, and competition.

Regional dynamics: China steadies, India rises

In 2024, Asia Pacific’s 66 per cent share underscores the region’s pivotal role in aluminium consumption. A focused China market analysis indicates continued, if more calibrated, usage growth—supported by vehicle electrification, grid upgrades, and consumer-packaged goods—while India and other emerging economies are poised to contribute a rising portion of incremental demand as they pursue energy independence, infrastructure buildout, and carbon-neutrality goals.

For market participants, these shifts argue for granular business market research at the sub-regional and sector levels to identify the focus market pockets where demand velocity, policy support, and supply-chain readiness intersect.

Short-run outlook: Nominal growth, firmer footing

In the near term, global aluminium demand is expected to grow at a nominal 2–3 per cent pace. Conditions remain subdued in pockets due to continuing geopolitical and macroeconomic headwinds. Even so, a combination of easing financing costs, public-sector infrastructure programs, and electrification tailwinds should sustain a modest uptrend through 2025.

For producers, converters, and OEMs, the implication is clear: maintain disciplined capacity planning, double down on competitive landscape analysis, and build optionality in procurement and customer portfolios to expand market share as the cycle turns.

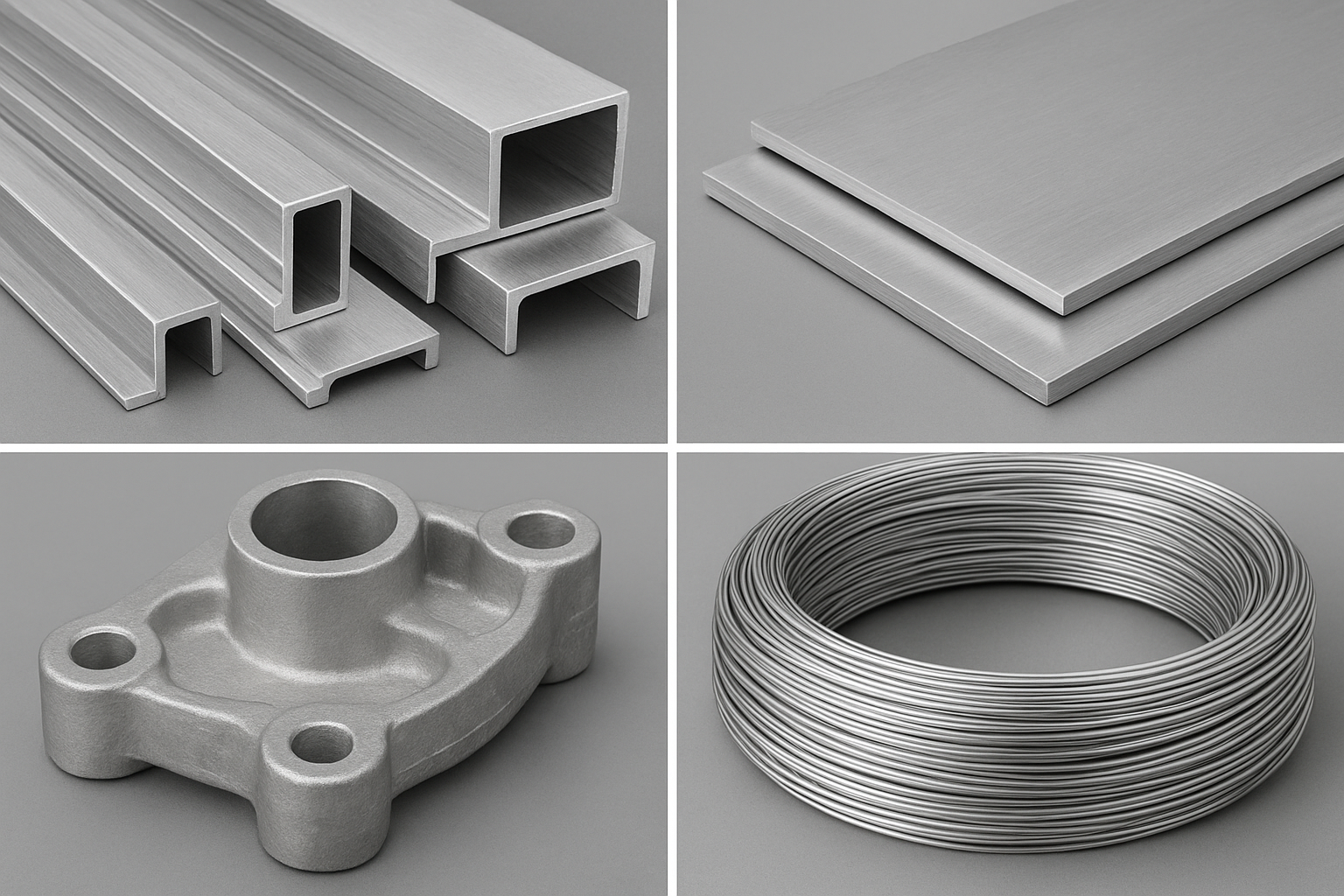

Product mix: Extrusions lead, FRP close behind

By product group in 2024, extrusions account for ~34 per cent of global usage, reflecting their ubiquity in construction systems, transport, and industrial applications. Flat-rolled products (including foil) represent ~32 per cent, buoyed by packaging, automotive sheet, and battery-foil momentum. Castings comprise ~23 per cent, continuing to benefit from powertrain and structural applications. For suppliers, targeted consumer product research—for example, into can-end design, EV battery enclosures, and architectural systems—can reveal higher-margin niches and specification-led stickiness.

Looking for insights into the fast-evolving aluminium flat rolled products market? "Aluminium Flat Rolled Products: Insights & Forecast to 2030" covers global trends, grade-wise demand (1XXX, 3XXX, 5XXX), and key end-use sectors. From regional shifts to industrial drivers, it’s your roadmap to understanding this vital industry.

Strategy playbook: Where to win next

What buyers and sellers should watch

Bottom line

Despite a cautious macro backdrop, aluminium’s role in electrification, sustainable packaging, and modern infrastructure keeps the medium-term outlook constructive. With 2025 consumption pencilled at 104.7 million tonnes and a glidepath to 122 million tonnes by 2030, the industry’s next leg hinges on executing against the most resilient demand nodes—BEVs, batteries, cans, and construction—while sharpening regional strategies in the Asia Pacific and rising emerging markets.

Responses