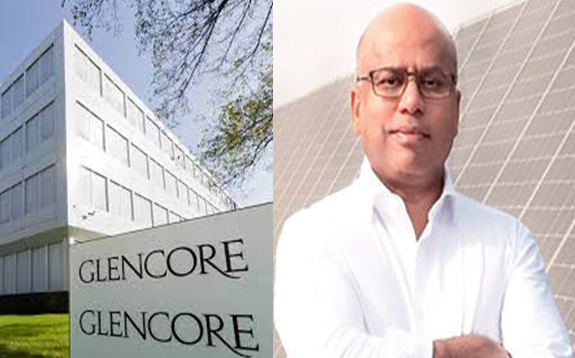

The British metal magnate Sanjeev Gupta is in discussions with commodity trading house Glencore to refinance debt at his European aluminium business, a deal which would permit Gupta to retain control of one of his best assets.

Sanjeev Gupta owned GFG Alliance employs around 35,000 people from the UK to Australia, has been struggling to restructure and refinance its debt after the collapse of its principal lender Greensill Capital.

The Anglo-Swiss multinational commodity trading company, Glencore is in talks to refinance more than $500 million of debt towards the business of GFG Alliance’s aluminium arm, Alvance with assets in France and Belgium, as reported by our sources.

Glencore’s agreement with GFG Alliance would empower Gupta to hold his chair as owner, invariance to a previous proposal from US private equity firm American Industrial Partners (AIP), which was eyeing to acquire the asset.

The deal, if done would be a privilege for Glencore’s aluminium business, as the FTSE 100 company could sell through its vast trading arm.

The shift from Glencore end comes following the surge in aluminium prices, which is almost 25% this year to above $2,500 a tonne as the global economy begins to regain from the pandemic. The lightweight metal aluminium is used in the production of everything from beverage cans to cars.

Dunkirk aluminium smelter in France, which is also the largest in Europe remains as the pride for Alvance. The 280,000-tonne aluminium production plant was acquired by Liberty from Rio Tinto in 2018 for $500m.

Glencore’s aluminium division that has been procuring the metal from Liberty is headed by Robin Scheiner and he said: “We are keen to expand the business and have been looking for potential deals.”

In 2021, Scheiner also met Gupta in Zurich where the duo brainstormed a number of ideas; however, no agreement was finalized, as per our sources.

GFG said: “We continue to focus on the restructuring and refinancing of our businesses following the collapse of Greensill Capital. The Alvance portfolio is performing well, supported by strong market conditions.”

While the commodity giant declined to comment anything as of now.

The deal with Glencore remains vital, as would repay several debt facilities across the Alvance business. The Dunkirk aluminium smelter in France has a $260 million loan against it, while Alvance’s rolling mill in Duffel has an additional $59 million of debt. The business also has $131 million of riskier holding company debt from BlackRock, and $73 million in financing from Greensill.

A syndicate of banks originally supplied the loan at Dunkirk, beside Glencore’s contender Trafigura. The banks mostly sold out their positions to AIP this year, when the New York-based private equity firm sought to wrest control of the asset, whereas, the Geneva-based commodity trader still holds this debt.

Responses