Germany's contribution in the progress of technology, engineering and innovation across industries has remained unparalleled since years. Ever since aluminium industry has felt the urge of riveting enhanced focus on downstream manufacturing to cater to the rising demand of the metal in various sectors, the country has played a key role in providing the right technology solution for aluminium extrusion, rolling and fabrication. The domestic downstream aluminium industry has also grown in tandem with the global market. One of the major product categories manufactured here comprises aluminium tubes and pipes fittings. While the consumption of the same has increased in the domestic sector, the export has declined over the last three years.

{newsStudioGallery}

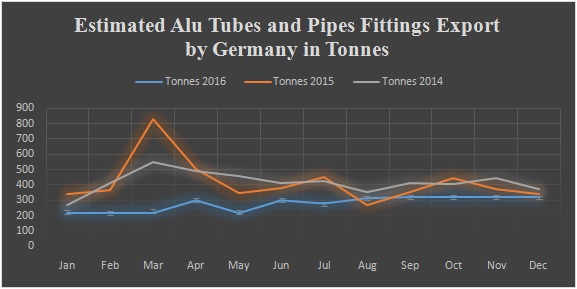

Germany exported 5030.69 tonnes of aluminium tubes and pipe fittings in 2014, which dropped 0.1 per cent to total at 5025.56 tonnes in 2015. In 2016, the volume is estimated to shrink further to total at 3364.80 tonnes, down 33.04 per cent and 33.11 per cent from 2015 and 2014 respectively.

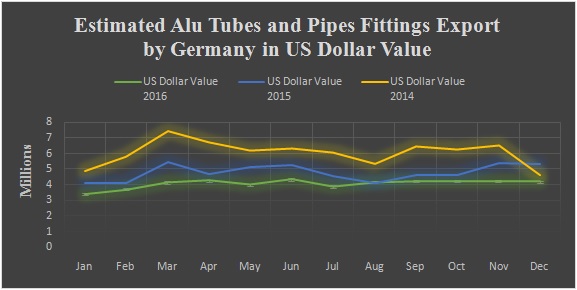

Earnings from export of aluminium tubes and pipe fittings in Germany have also dropped year-over-year. The decreased realization can be attributed to a number of macro-economic factors including change in currency value, freight rates and oversupply of fabricated aluminium products in the international markets originating mainly from China.

Germany's total export of aluminium tubes and pipe fittings was valued at US$72.9 million in 2014. In 2015, the European nation shipped aluminium tubes and pipe fittings worth US$57.78 million, down 20.7 per cent YoY. In the current financial year, the total value of aluminium tubes and pipe fittings exports from Germany is estimated to reach US$48.8 million, down 15.4 per cent YoY and 33.01 per cent from 2014.

{googleAdsense}

Though aluminium tubes and pipe fittings does not rank as one of the top exported product categories of Germany, a decline in the shipment volumes definitely indicates at key developments in the domestic as well as international markets. Many big aluminium companies have their manufacturing plants in Germany. Constellium’s plant at Singen, for example, is an aluminium manufacturing plant with over 1,600 employees. With its high-grade cold mills, integrated hot/cold rolling line and one of the largest extrusion presses in the world, Singen plant is one of Constellium’s largest sites. The SME sector has also flourished significantly.

As Martin Kneer, Managing Director of the German Non-Ferrous Metals Association (WVM) says, "Infrastructure expansion and prosperity gains in third countries will keep driving the demand for non ferrous metals. The goal during this process must be to leverage the know-how available in Germany: We have the best, most efficient and most eco-friendly technology right here."

Responses