您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

Europe’s renewable boom has a two-faced economy. On long, bright, windless days, it floods grids with cheap or even negative-priced power; when the weather turns, capture prices, as in the money actually earned by wind and solar assets after weighting by when they produce, recover sharply. That swing is not academic for aluminium. The metal’s primary production is among the industry’s hungriest electricity consumers, and swings in capture and wholesale power prices cut straight to smelters’ margins, investment plans and decarbonisation pathways.

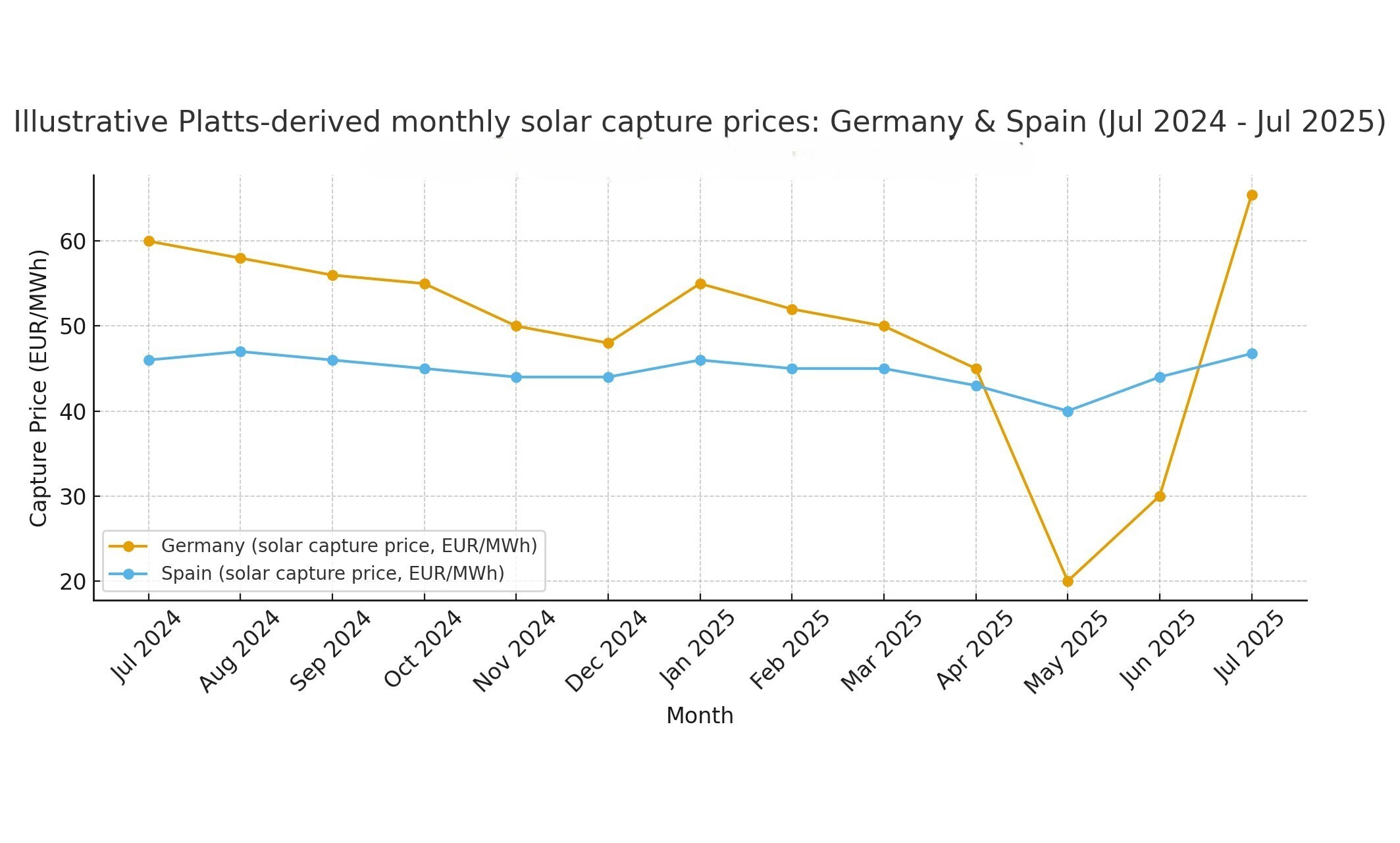

S&P Global’s Platts Renewable Energy Price Explorer shows exactly this dynamic playing out through mid-2025. Solar and wind output across Europe’s five largest markets rose about 10 per cent year-on-year in July, but output eased from June’s record highs and capture prices rebounded. In Germany, solar’s capture rate surged to 75 per cent in July, the highest since February, up sharply from a Q2 average of just 51 per cent. Consequently, German solar capture prices jumped to about EUR 65 per MWh, recovering from five-year lows in May–June.

Spain told a different story! Prices started in July in bullish fashion, but windier, cooler weather in the latter half of the month eased pressure. The country’s solar volume-weighted average settled at EUR 46.76 per MWh, a touch below July 2024 but still well clear of the spring slump.

Platts also reports that a growing feature of high-solar months, which is the number of negative hourly prices, fell sharply in July compared with the second quarter.

From capture prices to smelter balance sheets

Why should aluminium executives care about capture prices? Because producing a tonne of primary aluminium consumes a lot of electricity, recent industry studies and white papers put the ballpark between roughly 14,800-19,000 kWh per tonne of primary metal, depending on technology and cell efficiency. That makes electricity one of the single largest cost items in smelting, in many market settings accounting for a third or more of cash costs, and it also determines the carbon intensity of the metal. In short, variability in power value and availability changes both profit and the credibility of low-carbon claims.

Responses