Germany is currently experiencing an economic slowdown, and unfortunately, the aluminium industry is not immune to this challenging situation. It faces significant hardships due to elevated energy costs and the overall economic downturn.

Rob van Gils, the President of Aluminium Germany (AD), emphasised, “The year 2023 has shown very clearly that the energy transition strategy in its current form is not working. Over-regulation, massive bureaucracy, and a lack of understanding of the importance of industry for prosperity and participation in Germany are damaging acceptance of the need for a clever climate protection policy.”

Source: AD

The outlook and review are equally impactful

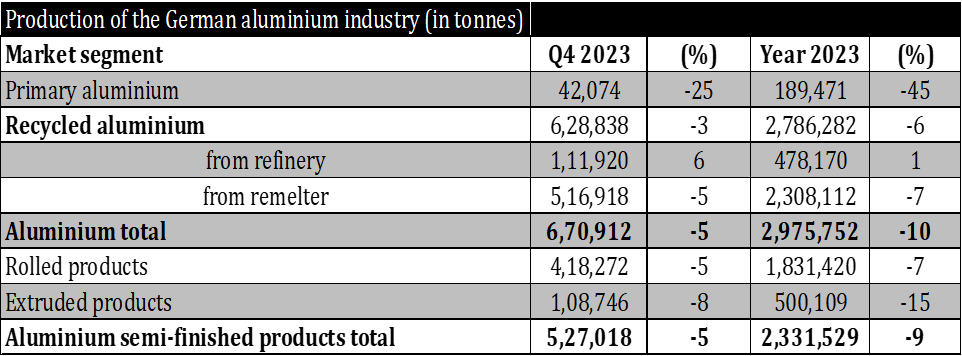

In 2023, the German aluminium industry experienced substantial reductions in production across various sectors, with primary production notably affected. Following a decline of over 30 per cent in the preceding year, German smelters saw a further 45 per cent drop, resulting in production totalling 189,000 tonnes. This figure represents just over a third (37 per cent) of the pre-energy crisis volume. Comparatively, even in 2009, Germany produced a significantly higher amount of primary aluminium during the global economic and financial crisis. Until 2021, Germany held the position of the largest primary aluminium producer in the European Union. However, due to the persistent challenges in the German electricity market, companies were compelled to implement drastic measures. Consequently, one of the remaining four German aluminium smelters ceased operations at the close of 2023.

Companies experienced notable decreases in producing semi-finished aluminium products, witnessing a significant drop of 9 percent. The production volume, reaching 2.33 million tonnes, marked its lowest point since the financial crisis. Manufacturers of extruded products faced a particularly steep decline of 15 per cent, producing 500,000 tonnes. Additionally, producers of rolled products saw a substantial decrease to 1.83 million tons, representing a 7 per cent reduction. Amidst grappling with challenging local conditions, these companies are also contending with heightened competition from importers in third countries where ecological, social, and ethical standards are considerably lower.

Rob van Gils continued, "We have repeatedly emphasised that the restructuring of European industry will not succeed without aluminium, resilient supply chains and more strategic independence from third countries. There is also an urgent need to put the importance of industry as a driver of employment and prosperity back at the centre of political decision-making. It's not good news if CO2 emissions fall to their lowest level since the 1950s in 2023. This is not the result of smart energy policy, but the result of catastrophic economic policy."

Outlook 2024

As the new year unfolds, members of the AD (presumably an organization or association) express significant apprehension regarding Germany's status as an industrial hub. They ponder a valid question about whether bold entrepreneurship, innovation, and their role in fostering economic well-being receive due political acknowledgement and appreciation. While businesses can navigate economic fluctuations, the growing burden of excessive regulation accompanied by moral scrutiny poses a challenge, especially without a clear industrial policy direction.

The President of AD said, “Our companies have been investing in more efficient and, therefore, lower CO2 production for years. Our products and processes keep the footprint in mind as an important goal with us and our customers. Instead of strengthening and supporting this development with clever framework conditions, additional burdens are added yearly, month after month. This cannot and will not last for long. The stock market wisdom applies here, too: the jobs aren’t gone; they’re just somewhere else.”

Discover the global aluminium industry's performance in 2023 and its outlook for 2024 with AL Circle's latest industry report, "Global Aluminium Industry Outlook 2024".

Responses