Asia-Pacific, where labour is affordable, setup costs of plants are cheaper and regulations are more friendly for business owners and stakeholders, have grown to become the focal point of the aluminium industry in the past decade. But what seems like a regional jump is a fruit of longstanding geopolitical blips and economic volatility. From culture to couture, production to market capture, the west has led the game for centuries. But as we approach the half of the ongoing century, a single question nags the mind. Why is the east now replacing the west (for aluminium or not)? And the answer is simple — availability beats class.

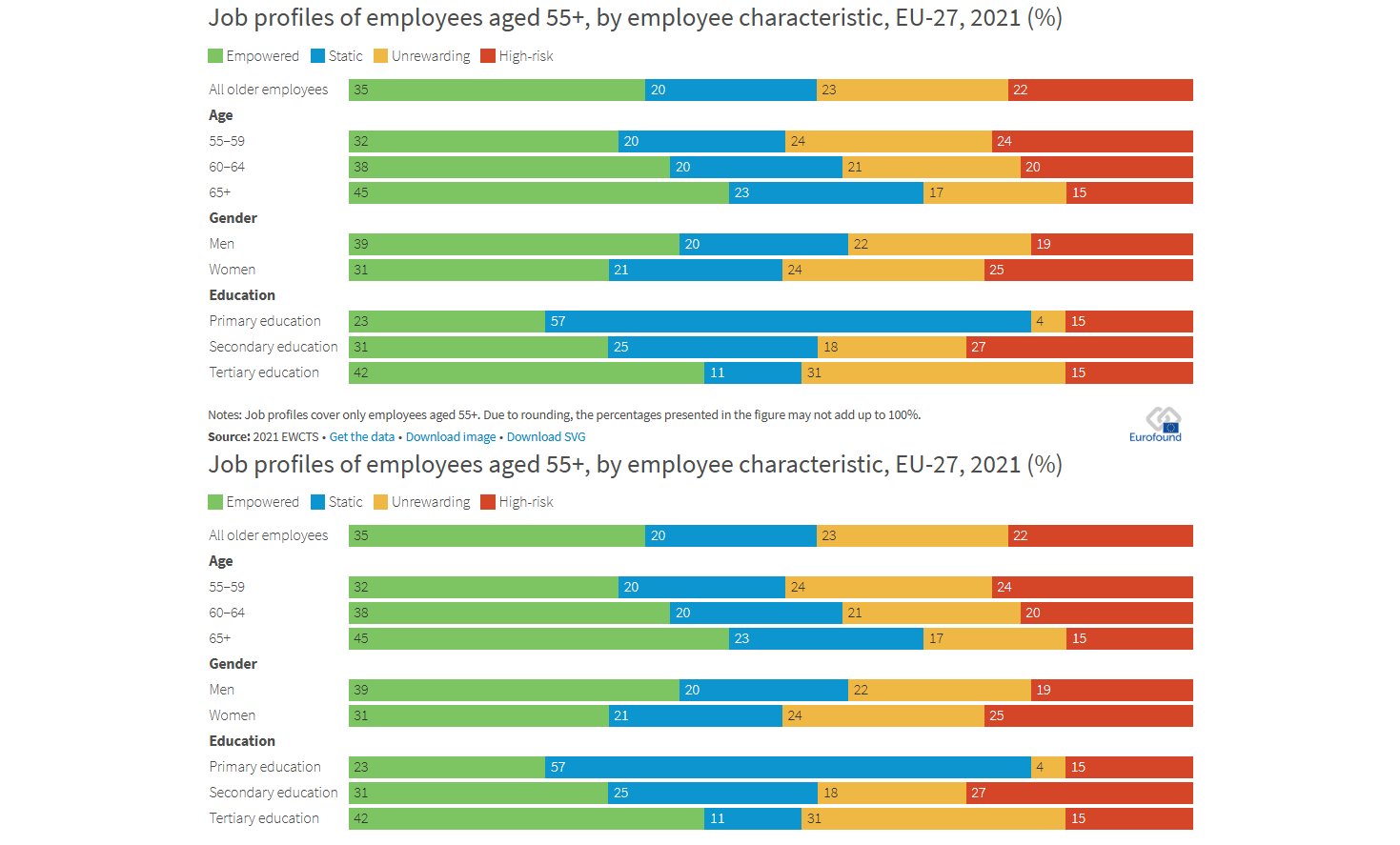

Image source: https://www.eurofound.europa.eu/

Also read: From €15.6B to €2.8B: Eurozone’s June trade surplus collapses under tariff pressure

US economic fallout

The macro tectonics have shifted. The United States has downgraded from a high-octane, demographic-fuelled growth model to a slower, ageing-and-productivity constrained one. At the same time, large parts of Asia-Pacific, inclusive of India, Vietnam, Indonesia and others still run on rising labour, above-average investment and a catch-up productivity story. For aluminium producers, traders and other stakeholders, that pivot matters as demand centres, capex flows, tariff exposure and supply-chain geography will all reprice over the coming decade.

Start with the headline numbers. The Congressional Budget Office’s long-run baseline now pegs the ‘new normal’ US real GDP growth at roughly 1.6 per cent per year from 2025 to 2055. It’s a far cry from the 3 per cent era.

The Bureau of Labor Statistics projects the US labour force will expand at only 0.4 per cent annually through the 2022–2032 window, with the participation rate falling from 62.2 per cent (2022) to 60.4 per cent (2032) as baby boomers (born between 1946 to 1964) retire.

Au contraire, S&P laid out at its August 2025 APAC conference that the potential output growth in many Asian EMs materially above advanced-economy peers, driven by higher investment rates and still-positive productivity convergence. Countries such as India, Vietnam and Indonesia look set to deliver GDP growth in the mid-to-high single digits over the near term, while China’s growth — though moderating — remains significant.

Responses